There is no doubt in saying that success in the Property & Casualty (P&C) sector is significantly dependent on the accuracy of the underwriting process and the efficiency with which claims are collected. While this appears to be a straightforward process, the number of factors impacting underwriting is growing increasingly complicated.

Insurance firms, on the other hand, acquire massive volumes of data in diverse formats distributed across numerous business units. As per Venture Beat, “The rate of data growth worldwide in the past few years has been greater than in the previous two decades." The majority of this data is unstructured, which makes it difficult for underwriting teams to stay ahead of competitors and boost revenues.

Underwriters spend a lot of time seeking relevant information from these massive data sets to complete their tasks. Due to the complexity and huge volume of unstructured data, manual analysis becomes expensive, time-consuming, and laborious. This disconnect makes it even more difficult for insurance carriers to maintain compliance, assess risks, and preserve the brand reputation.

While P&C firms are on the brink of huge opportunities to stay ahead in the ever-changing world of insurance, what can they do to enhance their underwriting process, standardize age-old manual processes, and assure accurate risk assessment?

Tapping into the power of Artificial intelligence and Machine Learning can undoubtedly play a vital role in achieving these outcomes. By applying a layer of cognitive intelligence using modern tech stacks of AI and ML, P&C insurers can almost eliminate the volatility that has historically defined underwriting.

With that note, this blog explores the traditional underwriting challenges and how modern technologies like AI and ML can be used for more accurate risk assessment in P&C insurance underwriting.

Key Drawbacks of Manual Underwriting in the Insurance Industry

Manual underwriting in the insurance industry has its fair share of challenges.. Here we talk about the bottlenecks in manual underwriting:

Lengthy Processes

Takes up a lot of resources and can lack accuracy resulting in delayed underwriting decisions, leading to a loss of business and customer dissatisfaction.

Increased Complexity:

Involves lengthy form fill-ups, complex fine print, errors & omissions, higher premiums, and a lack of product customization leading to longer turnaround times and higher customer attrition rates.

Decreased Efficiency

Requires too many resources which can affect the efficiency and productivity of the organization adversely.

Inaccurate Risk Calculations

Entails too many errors when developing risk profiles or determining the level of risk for each individual due to which underwriters may miss critical information or make mistakes when assessing risk.

These limitations underscore how difficult manual underwriting is. By implementing AI and ML models in underwriting, next-generation insurance companies can overcome these hurdles and reap the benefits of more efficient and accurate risk assessment. But, what are the major advantages of artificial intelligence in underwriting? Let's see!

AI and ML in Insurance: Transforming the Future of Risk Assessment in Underwriting

The Challenge

Insurance industry is all about managing risks, and with the influx of digital data, underwriters often find themselves inundated with proposals of varying formats and volumes.

This is one of the huge challenges for insurers to efficiently use their time and thoroughly assess each proposal before issuing a policy.

The Potential Solution

Artificial intelligence and Machine Learning are undoubtedly making waves across the P&C insurance industry and have revolutionized the underwriting process. They have enabled faster processing of complex profiles and proposals, resulting in smarter risk assessments, streamlined processes, better customer experiences, and higher client satisfaction. This allows underwriters to focus on the ones with the highest risk and save valuable time.

Two ways that demonstrate the potential of AI and ML in risk assessment are discussed below:

Automated Workflows

Insurance companies receive a large volume of proposals, and the challenge lies in quickly identifying those with a high probability of good behavior. Emerging AI & ML models can automate this workflow, accelerate entire processes, and delegate only high-risk proposals to human attention, resulting in better data-informed policies and improved customer experiences.

Besides, AI solutions can also help to decrease the time taken to introduce new pricing frameworks and get information and insights faster. For instance, insurers can leverage chatbots to deliver relevant insights through remote digital experiences during risk assessment.

Enhanced Risk Predictions

Fraud detection is crucial for the underwriting and claims team, but with increasing claims, it's challenging to identify genuine versus fraudulent claims. AI and ML can help insurers by flagging high-risk proposals for early claims based on past claims experience.

Using a segmented approach, ML models can compare proposer profiles with the insurer's existing profiles to generate recommendations. This will allow underwriters to make informed decisions on underwriting, investigation, or deferral of proposals, ultimately aiding them to save a significant amount of time and capital.

In a Nutshell

The insurance industry's investment in AI for underwriting is at its finest right now. Major insurers have already begun to broaden the function of underwriting to better reflect the complexity of the modern world.

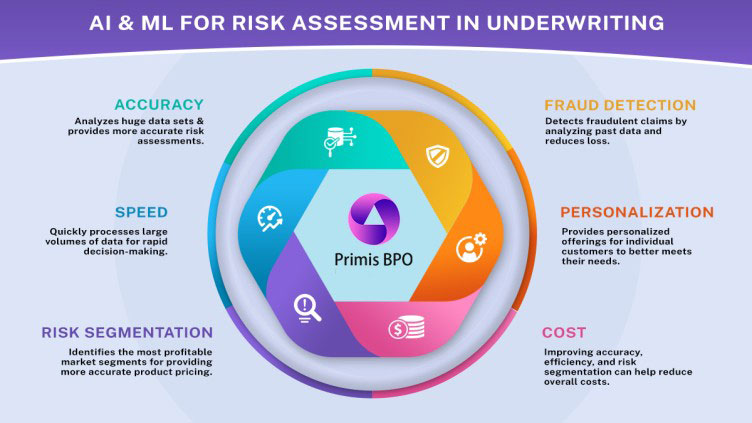

The use of these technologies is bringing about a revolution in how insurers assess risk in this changing industry landscape. Briefly put, AI and ML can help insurers:

- Analyze vast amounts of data

- Develop more accurate risk profiles

- Improve the overall efficiency of the underwriting process

As the sector continues to evolve, it is clear that AI and ML will play a significant role in shaping the future of insurance. Those who embrace these technologies will be the ones who come out on top, creating compelling experiences for their clients and gaining a competitive advantage.

Are you ready to revolutionize your underwriting process? Contact us now to enhance your risk assessment with AI and ML.

Recent Blogs

The AI FTE Approach to Property Risk Assessment

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization