In today's fast-paced world, businesses are facing an array of market pressures like rising customer expectations, increasingly complex risks, etc., and are constantly searching for ways to streamline their processes and improve efficiency. The insurance industry is no exception. Traditionally, the submission intake process in the insurance sector was inconvenient, highly manual, and error-prone. But in recent years, despite the shift to digital submissions, the processes and approaches have remained largely the same over the years.

Then, what should insurers do to spend more time with customers and focus on delivering a better client experience instead of being bogged down by cumbersome, error-prone manual submission processes?

The answer to this problem is automation. The emergence of automation and AI solutions in the insurance industry has revolutionized its submission intake process. It has opened up a gamut of opportunities for carriers in order to enhance efficiency, productivity, customer satisfaction, and improve submission throughput.

In this blog, we will discuss the challenges posed by manual & complex submissions and will delve into the benefits of using AI-based solutions to streamline the insurance submission intake process.

Manual Insurance Submission Intake Challenges

Incomplete & Inaccurate Submissions

One of the most significant challenges in manual insurance submissions is the inaccuracy and inadequacy of data provided by customers, agents, or brokers. The submission process can become time-consuming and error-prone as underwriters are required to spend a lot of time manually validating the information from multiple sources. Moreover, missing documents and incomplete information can result in the carrier spending more time resolving the issue. As a result, this might lead to delays, customer dissatisfaction, and potential losses for insurers.

Security Risks

Manual submission intake can pose security risks, as it involves handling sensitive information such as personal and financial data. If this data is not handled and stored securely and confidentially, it can be vulnerable to theft, fraud, and other security breaches.

Inconsistent Data

Manual submission intake can lead to inconsistent data, as data may be entered in different formats or may not follow a standard format. This can make it difficult for insurers to process and review the information accurately and efficiently, leading to increased turnaround times and potential errors.

Complexity of Regulations and Compliance

The insurance industry is highly regulated, and carriers must comply with numerous regulations and guidelines. Manual submission intake can make it challenging to ensure compliance, as it requires carriers to manually process information to ensure that it meets regulatory requirements.

Time-consuming & Tedious

Manual insurance submission intake can be a time-consuming and tedious process, as it requires carriers to manually process and review large volumes of documents and data. This can result in delays and backlogs, which can have a crucial impact on customer experience, leading to customer attrition.

From Manual to Automated: The Path to a More Productive Insurance Submission Process

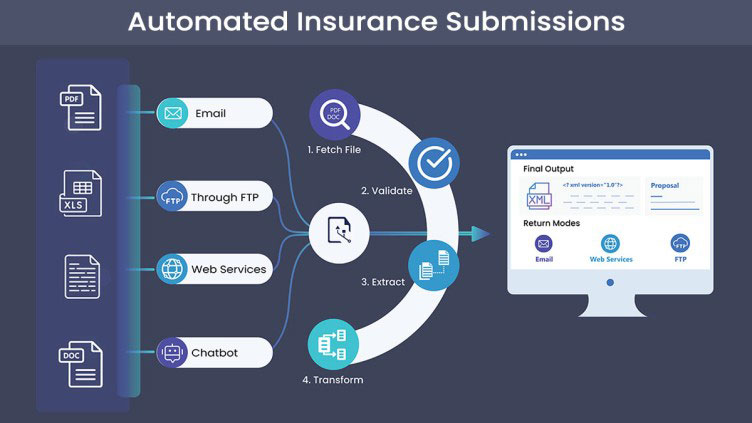

Automating insurance submissions enables carriers to complete the entire process seamlessly without any hassle. AI facilitates a bot to read, extract, and understand insurance-specific data points in submissions of various formats just like a human – only within a quick turnaround time. AI removes the need for underwriters to sift through multiple documents for manually sourcing data and insights needed for assessment and pricing.

Here are a few ways in which automated submission intake can aid insurers to increase productivity and efficiency:

- Automating insurance submission processes enables insurers to leverage touchless data extraction from multiple sources with 99% accuracy. This saves time and reduces errors in data entry, leading to more efficient underwriting.

- Automating insurance submissions can enrich missing data from legacy systems or other sources, leading to more comprehensive risk assessments and informed decision-making.

- The use of AI-based models enables carriers to process submissions from all channels 24x7. Besides, data prefill accelerates the quote process while eliminating manual data entry. This reduces turnaround time and improves customer experience.

- Lower underwriting costs and reduced operational overheads can be achieved by automating the insurance submission process, thereby resulting in overall cost savings.

- Automated insurance submission processes can lead to improvements in direct written premium and loss ratios, writing more premiums in less time and with fewer resources, as well as 2X quote-to-submission and bind-to-submission ratios. This helps insurers increase business, reduce costs, and improve profitability.

- The overall cycle time can be reduced, and manual intervention needs can be significantly eliminated or decreased by leveraging automation in submission intake. This improves efficiency and reduces processing time, leading to faster decisions and an enhanced client experience.

- Decision-making can be improved due to better quality, enriched data that can be leveraged for advanced analytics. This allows insurers to make more informed decisions and reduce the risk of losses, leading to improved profitability.

To Conclude

While AI is not a magical solution, its capabilities are undoubtedly powerful. By leveraging AI in insurance processes, carriers will be able to automate age-old, manual submission processes. When AI and human underwriters work hand-in-hand, it enables to power up efficiencies, drive down loss ratios, and improve communications. Ultimately, this helps insurers deliver better client experience and stay ahead of the competitive curve.

So, what are you waiting for? Get in touch with us and start exploring our automation solutions.

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence