Bridging the Gap Between Manual Workforce and Machine Precision to Transform Insurance Underwriting

Key Takeaways

- Augmented underwriting blends the precision of AI with the judgment of seasoned underwriters.

- Outsourcing underwriting to BPOs helps insurers scale intelligently using a mix of human talent and AI-driven FTEs.

- AI FTEs deliver accurate, fast, and bulk risk assessments across multiple lines of business (LOBs).

- Digital tools enable composite risk scoring, smart data collection, and automated underwriting recommendations.

- Human experts continue to play a vital role in judgment-heavy, ambiguous, and relationship-driven scenarios.

A Shift That’s More Than Just Digital

Imagine an underwriter who reviews several policies in a short amount of time flawlessly, without human error, all while working in tandem with seasoned professionals who bring decades of judgment and experience to the table. This isn’t the future. This is augmented underwriting in action.

Underwriting is undergoing a silent revolution. Once heavily reliant on gut instinct, paper forms, and hours of manual analysis, the function has been transformed by artificial intelligence and automation. Yet, at its core, it remains a human-led, experience-rich process.

This blog will explore how augmented underwriting, powered by a blend of human expertise and AI-driven intelligence, is transforming the insurance landscape through smarter risk analysis, faster decision-making, and scalable outsourcing models.

What’s Augmented Underwriting?

Augmented underwriting—a model where digital intelligence doesn’t replace the underwriter, it empowers them. And nowhere is this transformation more strategic than in outsourced underwriting services, where human FTEs and AI-powered digital underwriters (digital FTEs) work together to deliver a smarter, scalable, and more customer-centric insurance ecosystem.

The Rise of Outsourced Underwriting: Blending AI FTEs with Human Judgment

Traditionally, underwriting has been labor-intensive—manual data entry, static risk models, delayed decision-making, etc. Insurers today are increasingly turning to outsourcing partners to scale underwriting, reduce costs, and access global talent. What’s different now is how BPO firms deploy “Digital FTEs”—AI agents trained to handle underwriting tasks across all lines of business. Together, they offer an augmented model of speed, precision, and personalization.

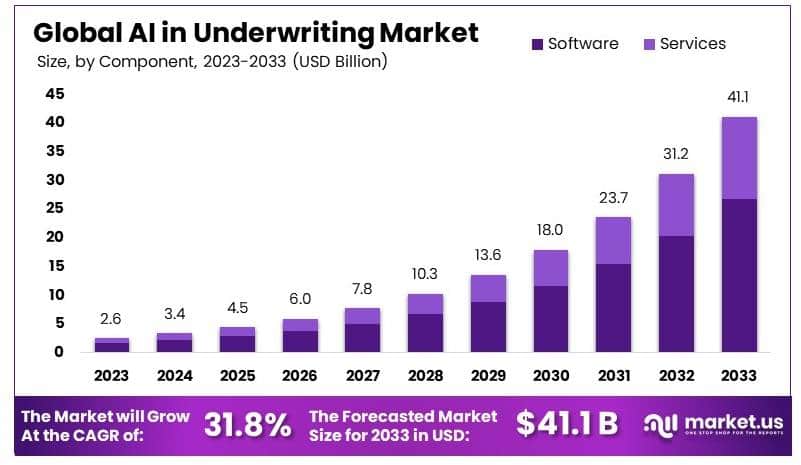

As per a recent report, the global AI in underwriting market size is expected to be worth around USD 41.1 billion by 2033, from USD 2.6 billion in 2023, growing at a CAGR of 31.8% during the forecast period from 2024 to 2033.

The report further highlights that AI in underwriting also enables personalized risk assessments, allowing companies to offer more tailored products to customers.

The Role of AI-Powered FTEs in Optimizing Underwriting

Let’s explore the core digital agents that are transforming underwriting workflows through outsourcing:

1. Data-Driven Insights for Precise Underwriting

AI systems consolidate structured and unstructured data from internal sources (claims history, customer records) and external sources (weather models, credit data, cybersecurity indices). This unified data hub supports:

- Standardized evaluations

- Real-time updates

- Higher underwriting accuracy

2. Automated Risk Evaluation Across Multiple Domains

Digital FTEs assess diverse risks instantly:

- Property Risk Assessment Agent

-

- Evaluates environmental (wildfire, flood), structural, and

historical claims data

-

- Leverages geospatial analytics to predict future risks

- - Automates underwriting recommendations with AI-generated insights

- Cyber Risk Assessment Agent

- - Evaluates phishing, ransomware, malware, and insider threat

exposure

- - Maps historical data on breaches and threat trends

-

- Assigns cyber risk scores to enable precise premium pricing

- Auto Risk Assessment Agent

- - Monitors driver behavior, telematics data, and claims history

-

- Predicts loss exposure using real-time inputs

-

- Suggests dynamic premium pricing based on risk fluctuations

3. Composite Scoring & Summary Reports

AI underwriters aggregate multi-domain risks to:

- Generate multi-policy risk reports simultaneously

- Aggregate threat types (e.g., fire + cyber + auto) for unified scoring

- Deliver concise summaries that underwriters can act on instantly

This holistic view improves risk segmentation and enables customized policy recommendations—all while trimming turnaround times.

AI vs Human Expertise: Striking the Right Balance

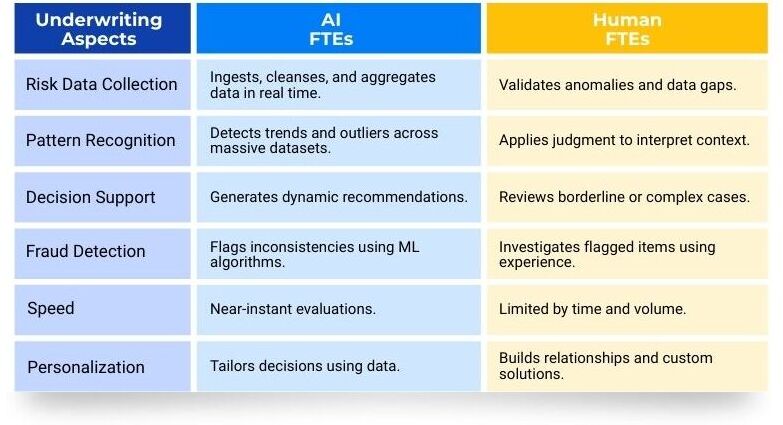

Outsourcing providers ensure human-AI collaboration by aligning AI-driven digital FTEs with traditional underwriters. Here’s how the balance works:

AI Complements, Not Replaces, the Human Touch

The goal of augmented underwriting is not to eliminate human underwriters, but to free them from manual, repetitive processes and allow them to focus on what truly requires expertise:

- Strategic underwriting decisions

- Complex policy negotiations

- Building customer trust

- Analyzing new lines of business

In outsourcing setups, digital FTEs serve as the first line—processing volumes and flagging exceptions—while human underwriters take over to fine-tune and finalize decisions.

Looking Ahead: The Future is Augmented—and Outsourced

Underwriting is no longer about choosing between human intuition and digital precision. It’s about blending both intelligently. By outsourcing underwriting to BPOs equipped with digital FTEs and domain experts, insurers are creating resilient, scalable, and intelligent operations.

Are you planning to adopt augmented underwriting in your insurance business? Outsource your processes to Primis and embrace a faster, smarter, and more customer- centric future.

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence