The New Digital FTE Model for P&C Insurers

Key Takeaways

- Understand how outsourcing is transforming traditional insurance risk analysis into a scalable digital function.

- Learn how the synergy of human expertise and digital FTEs can drive accuracy, speed, and profitability.

- See how property intelligence enables underwriters to improve risk selection, reduce loss ratios, and fast-track decision-making.

Rethinking Insurance Risk Analysis: From Human-Only to AI- Augmented

Risk analysis has long relied on human expertise—underwriters parsing reports, interpreting inspections, and weighing risks based on experience. While invaluable, this approach struggles under today’s demands:

- Growing submission volumes

- Increasingly complex risk variables

- The need for real-time decisions

Traditional models are no longer enough. The modern market demands more. More speed. More accuracy. More intelligence.

Welcome to the era of AI-enabled Risk Analysts—your new Digital FTEs—not just to cut costs, but to elevate decision-making itself.

This blog explores how outsourcing to AI-powered digital FTEs is redefining property risk analysis by augmenting traditional manual workflows, thereby enhancing underwriting precision and profitability.

Introducing the Property Risk Analyst: Your AI-Powered Digital FTE

Your underwriting desk now has a new team member. Trained on massive datasets and embedded with predictive intelligence, the AI-enabled Property Risk Analyst is a Digital FTE purpose-built for next-gen underwriting.

Capabilities of the AI FTE Include:

1. Multidimensional Property Risk Evaluation

Analyzes environmental, structural, and historical claims data instantly. Evaluates fire, flood, crime, and other geospatial risks with high precision. This is achieved through real-time data ingestion and AI-driven pattern recognition across multiple data streams and geospatial layers.

2. Automated Risk Scoring & Recommendations

Generates real-time risk scores and underwriting recommendations, complete with justification and configurable thresholds. These scores are produced by processing structured and unstructured submission data through pre-trained AI models that instantly compare it against historical patterns, underwriting rules, and risk parameters.

3. Predictive Risk Forecasting

Learns from historical data to identify high-risk patterns and predict future losses, helping underwriters stay proactive rather than reactive. It does this by training AI models on past claims, loss events, and policy behaviors to recognize patterns that typically lead to future claims, flagging emerging risk trends before they escalate.

These AI models assess the probability and severity of risk factors, converting complex datasets into easy-to-interpret scores. Outsourcing this process ensures consistent, objective evaluations at scale.

The result? A hyper-contextualized, 360-degree view of every property, generated in real time.

What Makes Property Intelligence a Competitive Advantage?

When your risk assessment becomes AI-driven, your entire value chain accelerates. Here’s how:

Reduced Loss Ratios

Smarter risk selection means fewer surprises. Insurers see tangible reductions in claims volatility and improved portfolio profitability.

Underwriting Efficiency at Scale

No more bottlenecks. Digital FTEs handle high-volume processing while human underwriters focus on nuanced or complex cases.

Faster Turnaround, Higher Capacity

AI-driven risk assessment timelines drop from days to minutes—ideal for carriers managing high volumes of applications or peak season surges. Property quotes become quicker and more consistent.

Why Outsource? The Power of On-Demand AI Expertise

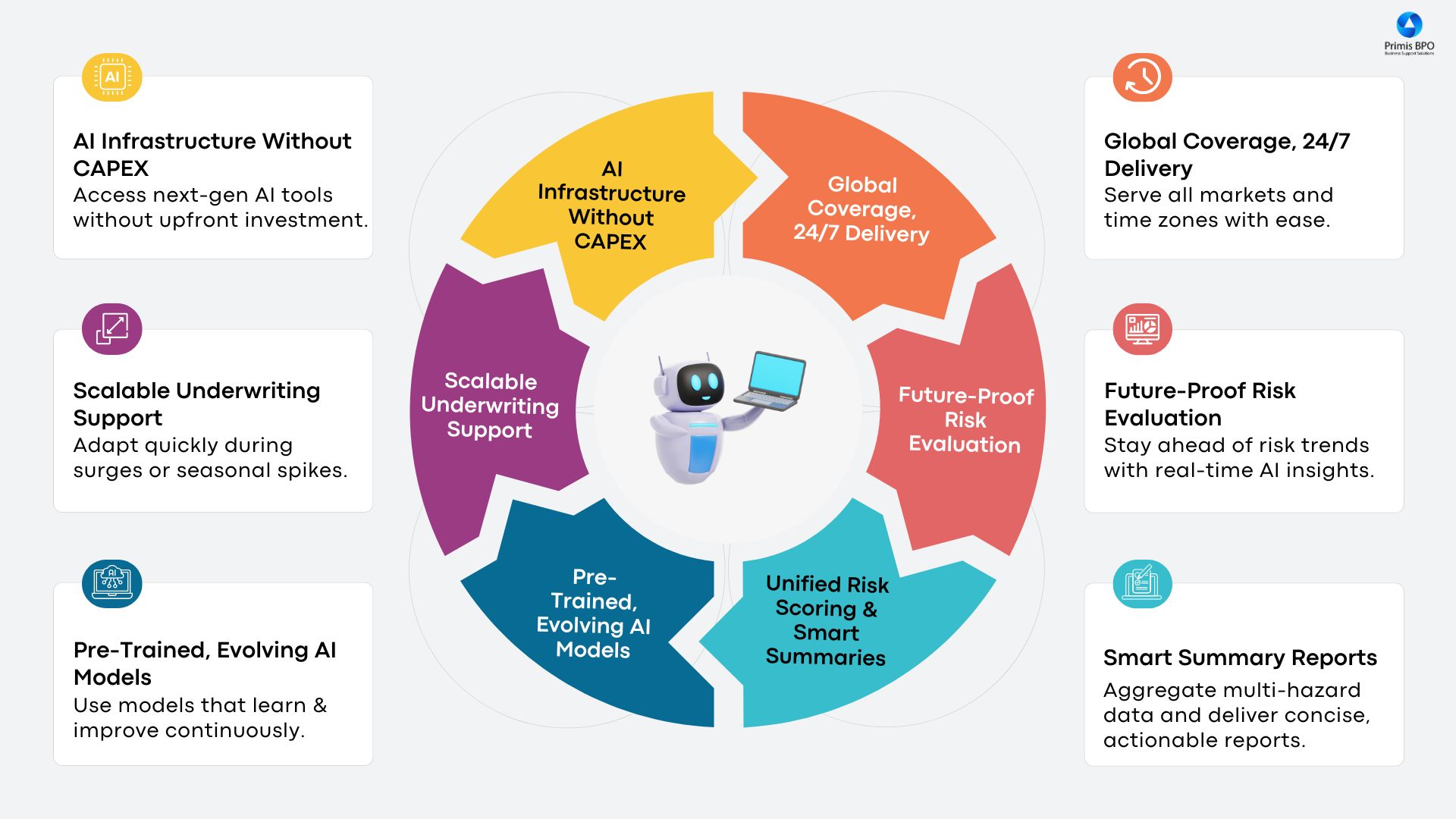

Outsourcing has long been used to handle back-office functions—but today, it’s being reimagined as a way to expand your digital capabilities without building them in-house. Outsourcing to a team of AI-enabled Property Risk Analysts gives insurers:

With the right partner, AI FTEs can be embedded directly into your underwriting workflow—no disruption, just acceleration.

Concluding Thoughts: The Future of Property Risk Assessment is Not Human vs. Machine. It’s Human + Machine.

For P&C insurers, precision and profitability are intrinsically linked. And the insurers who will lead tomorrow are those who act today by blending the expertise of human underwriters with the speed and scale of AI.

By outsourcing to AI-enabled digital FTEs for property risk analysis, you're not just saving time or money. You're redefining the way you assess, underwrite, and mitigate risk—with accuracy, speed, and confidence.

Welcome to the digital workforce of the insurance industry. Connect with Primis to learn more. Your next analyst might not sit at a desk, but they’ll be the smartest hire you’ve ever made.

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence