Having access to unlimited information and virtual services like comparing and buying policies online, customers now have higher expectations. The options have increased and so has the competition. With that, it has become imperative for insurance companies to provide seamless, on-demand service and a personalized experience to retain their customers.

However, it is quite challenging to meet these expectations with complex and old processes. If a company fails to meet their customers' expectations, they will quickly shift to another. And for that, insurers have to transform themselves with emerging technology.

Slowly and steadily, the changes are visible. Modern-day insurers are now investing in AI-powered insurance chatbots to improve their customer experience.

These chatbots are revolutionizing the insurance industry by enhancing the customer experience and improving operational efficiency. Not just that, they offer quick and easy access to information and help customers navigate through the complexities of insurance policies. A recent report highlights that "62% of customers would use an online chatbot instead of waiting for a representative."

This article highlights the role of chatbots in the P&C insurance industry and why they are the best choice for improving customer experience.

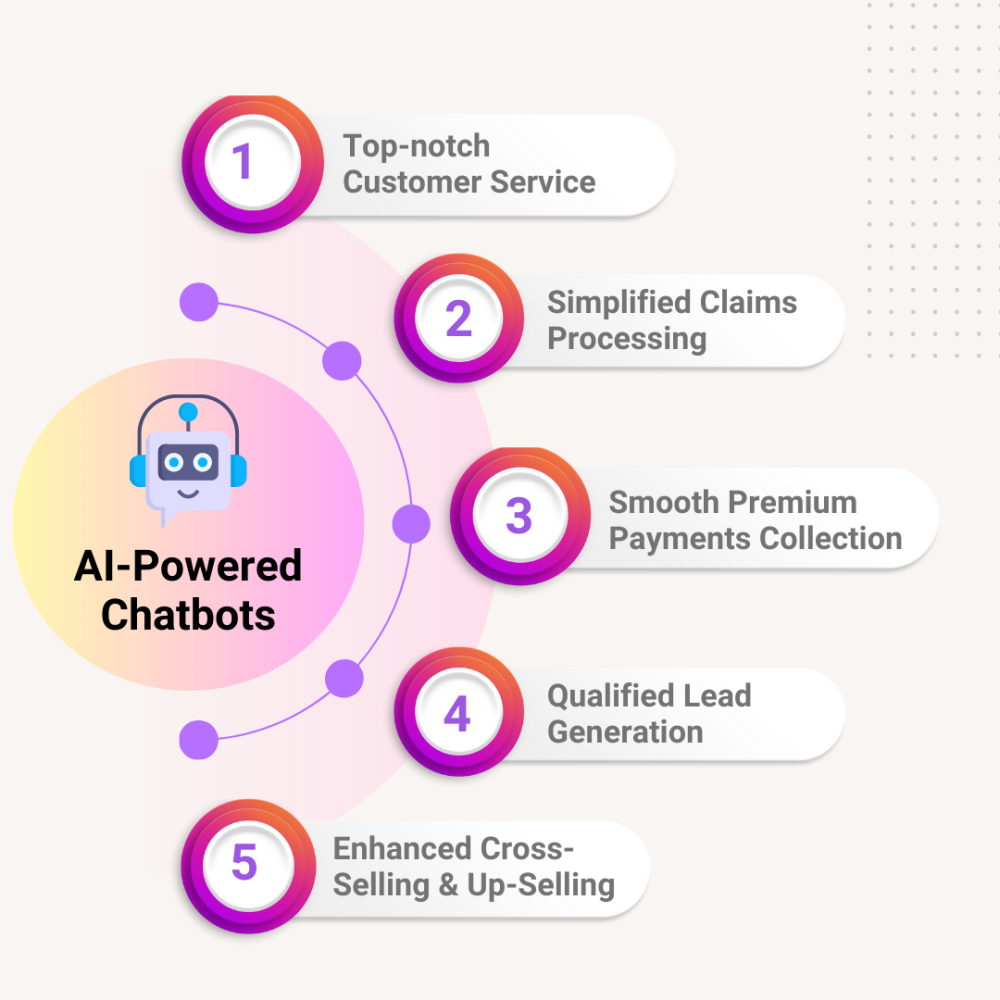

5 Effective Ways How AI-Powered Chatbots are Helping Insurers Enhance Customer Engagement

TOP-NOTCH CUSTOMER SERVICE

Challenge

Customer service professionals spend a lot of time providing information to their clients. The majority of the time, the client would have trivial queries about the service, and the executives would need to address their queries and concerns.

Solution

With AI-powered chatbots, effective solutions can be provided in a personalized and seamless manner. With this, the staff can focus on complex problems that require human assistance along with an option to connect with a live agent for better service.

Besides, chatbots can also make the new customer onboarding process smooth. With bots, policyholders will be able to gain 24*7 access to instant information about their coverage, deductibles, premiums, etc.

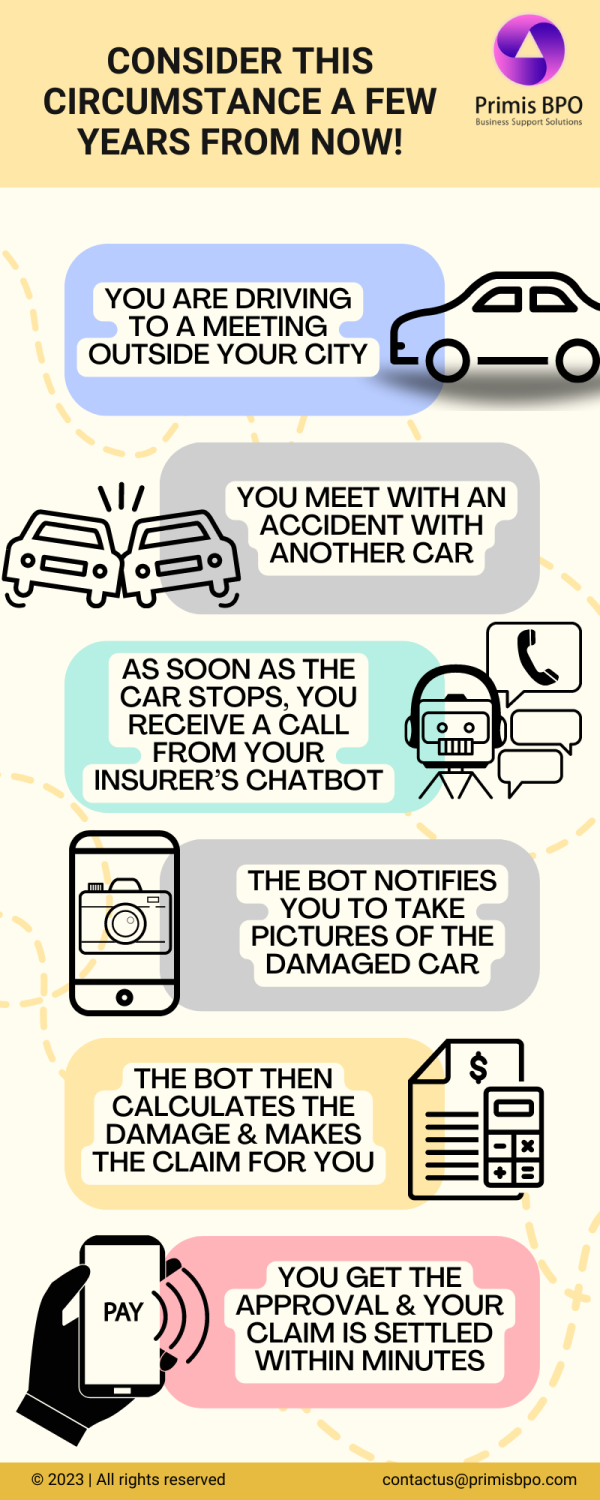

SIMPLIFIED CLAIMS PROCESSING

Challenge

Claim processing is a complicated affair involving providers, adjusters, inspectors, and agents. It takes around a month or sometimes even more to reach settlement. Meanwhile, policyholders have to continuously follow up with a representative to check the claim status.

Solution

With chatbots, the entire claims processing can be simplified by:

- Engaging in a conversation with the policyholder in the first place.

- Collecting the necessary data and requesting documents to streamline the claim filing process.

- Asking the policyholder to provide pictures or videos of damages in case of damage evaluation.

- Sending the data to a human agent for inspection or utilizing image recognition technology to assess the damage.

- Communicating the reimbursement amount to the TPA and finally to the policyholder once the damage assessment is done.

- Informing the client proactively about payment amounts, account updates, and payment dates.

SMOOTH PREMIUM COLLECTION

Challenge

In the insurance sector, premium payment collection and processing entails two parties. One is the customer, who wants to make the payment. The other is agent(s), the one who collect these premium payments. Often, this is a tedious and complex process that involves a lot of problems for clients in deciding where & how to pay.

Solution

Leveraging chatbots can help you smooth out this payment service. They can easily guide the customer through the payment process and getting acquainted with the platform better.

QUALIFIED LEAD GENERATION

Challenge

Manually generating leads can be a time-consuming process for businesses. Sales teams have to shift through numerous potential customers to identify those who are most likely to convert, leading to missed opportunities and lower conversion rates.

Solution

Utilizing chatbots in lead generation and scoring can play a significant role in making sure that only qualified leads are shared with the sales team. Besides sales, chatbots can help marketing teams focus on devising more engaging and personalized campaigns.

ENHANCED CROSS-SELLING & UP-SELLING OPPORTUNITIES

Challenge

When a customer tries to buy a particular insurance product, there is a small window of opportunity for cross-selling and up-selling. The most vital thing to consider here is making relevant product suggestions for efficient cross-selling, which is quite difficult.

Solution

Leveraging chatbots can help acquire previous customer data to predict and recommend insurance policies that is most likely to purchase. It can be integrated with recommendation systems and learning models that can logically guess the prospective products by remembering the client profile and the product they have bought earlier and provide suggestions for customers. Chatbots can convert the cross-selling and up-selling opportunity to a sale with a higher probability.

Chatbots or humans: What does the future hold?

The insurance industry is poised to embrace the power of chatbots in transforming the insurance value chain. Chatbots are expected to play a critical role in pre-purchase, purchase, marketing, customer service, and other back-end operations, providing unparalleled efficiency, speed, and accuracy.

Yes, this might sound a bit implausible, but in the next few years, we can expect this advancement level close enough to this situation.

So, you might be thinking, what about human agents? Will chatbots replace humans?

Well, not really!

The role of human agents will evolve from being mere intermediaries to becoming advisories. With the help of virtual assistants, agents will be able to concentrate on resolving complex issues, offering relevant coverage, and helping clients manage their portfolios. This will lead to high customer satisfaction and accelerate business growth.

Recent Blogs

The AI FTE Approach to Property Risk Assessment

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization