Financial transactions between businesses and customers have undergone a significant transformation due to automation. Managing traditional payment methods was challenging in the past, but with the advent of new-age electronic billing systems, transactions have become seamless and efficient.

E-billing has emerged as a game-changing solution for businesses aiming to optimize their billing processes and enhance customer experiences. Acting as a comprehensive platform, it simplifies sending and receiving bills electronically, making it convenient for both businesses and customers. Moreover, it offers customers the flexibility to choose their preferred payment channel.

The entire electronic billing process is digitized, covering everything from bill and invoice creation to payment facilitation. This digital approach is particularly advantageous for organizations that frequently issue recurring bills to their clients.

In this blog, we will explore the numerous benefits of e-billing and provide insights into its functioning.

Importance of Electronic Billing (E-Billing)

Crucial to modern finance, e-billing is vital to automating workflows and reducing reliance on paper-intensive operations within the accounts payable (AP) and accounts receivable (AR) departments. With the help of e-bills, accounting teams can easily balance and reconcile accounts, improving accuracy and efficiency in financial management.

E-Billing Process - Why Outsourcing is the Key to Success

Executing a seamless e-billing process involves multiple stages, including invoice creation, delivery, payment processing, reconciliation, and meticulous record-keeping. For many businesses, managing all these aspects in-house can be a daunting and resource-intensive task. This is where outsourcing proves to be a strategic move that can lead to significant benefits and efficiencies.

Here are the detailed steps involved in the e-billing process that can be outsourced:

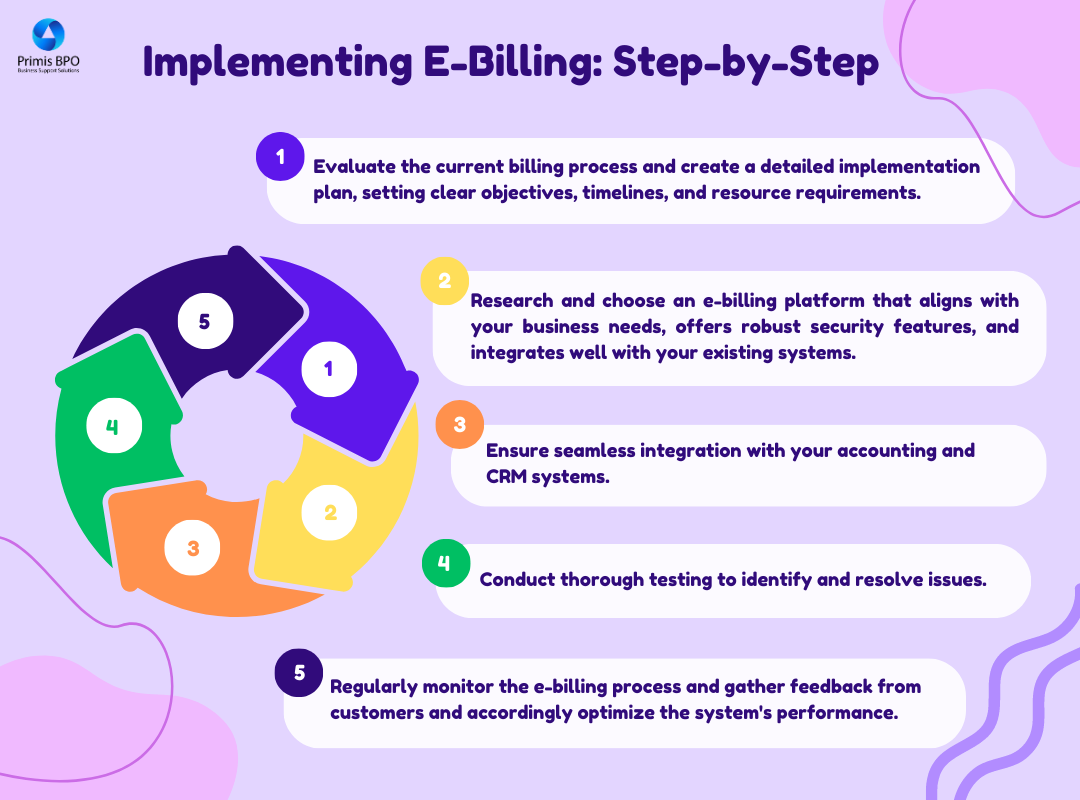

1. Invoice Creation

Outsourcing this critical step to specialized service providers ensures that invoices are generated promptly and adhere to industry best practices. Outsourcing providers utilize advanced invoicing software that can cater to specific billing needs, customizations, and branding requirements, resulting in well-designed and error-free invoices.

2. Invoice Delivery

Timely and secure invoice delivery is crucial to ensuring prompt payments and maintaining a healthy cash flow. Outsourcing e-billing enables businesses to leverage advanced delivery mechanisms, such as email, online portals, or even mobile apps, to provide convenient and accessible invoicing options for customers. This facilitates faster communication and engagement with clients, leading to swifter payment processing and a more streamlined billing cycle.

3. Payment Processing

Handling payments efficiently is a paramount aspect of the e-billing process. Outsourcing payment processing to specialized payment gateways or processors guarantees secure and seamless transactions. These providers integrate various payment options, such as credit cards, electronic fund transfers (EFTs), and digital wallets, giving customers the flexibility they need while also accelerating payment collection for businesses.

4. Reconciliation

Reconciling payments and resolving discrepancies is a laborious task that demands meticulous attention to detail. Outsourcing this aspect of the e-billing process to experienced professionals ensures accurate and timely reconciliation. Expert providers use advanced software to match payments with corresponding invoices, minimizing errors and reducing instances of late or missed payments.

5. Record-Keeping

Maintaining comprehensive and well-organized billing records is essential for financial transparency, compliance, and future reference. Outsourcing the record-keeping process ensures that all billing data is properly documented, securely stored, and easily retrievable. This not only enhances internal efficiency but also assists in audits, financial analysis, and decision-making processes.

By adopting electronic billing solutions, businesses can enhance efficiency, reduce errors, and provide customers with a more seamless billing experience.

Conclusion

E-billing offers numerous advantages, such as cost savings, improved customer experience, and streamlined business workflows. By following the implementation steps and best practices, organizations can unlock the potential of e-billing and reap its benefits. Additionally, outsourcing e-billing to a specialized service provider like Primis BPO enables businesses to focus on their core competencies while ensuring a seamless, secure, and cost- effective billing process.

Connect with our team today!

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence