Imagine a world where every crucial decision in the insurance industry is powered by precise data and insightful analytics. A world where you can confidently navigate the complexities of the insurance landscape armed with accurate predictions and actionable insights. Welcome to the realm of data-driven decision-making, where the magic of reporting services opens the doors to unprecedented opportunities for the insurance sector.

The insurance industry faces an avalanche of information. As per a recent report, it is estimated that 2.5 quintillion bytes of data are generated on a regular basis. Within this vast sea of data lies valuable information that can revolutionize the way insurance companies operate, strategize, and ultimately serve their clients.

To leverage this data effectively, consolidation into comprehensive reports is essential for in-depth analysis. This leads to an important question: Should insurance companies handle this process in-house or seek an external solution?

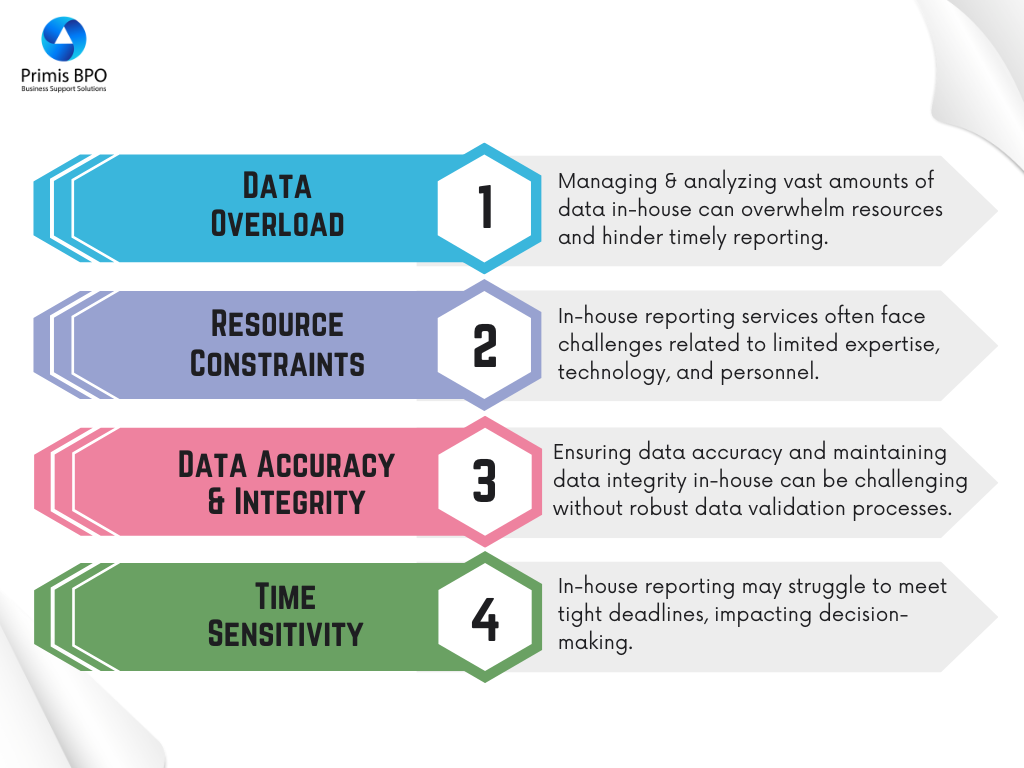

When considering in-house management, various challenges may arise. Let’s take a look at the top four obstacles:

However, outsourcing reporting services offer an optimal solution. By entrusting data consolidation and reporting to experienced professionals, insurance companies can focus on their core competencies, ensure efficient operations, and make data-driven decisions with confidence.

This blog explores how outsourcing data and reporting services will empower insurers to enhance business productivity and growth in the present competitive landscape.

From Data to Success: The Top 5 Perks of Outsourcing Your Data and Reporting Services

Streamlining Operations with Timely and Periodic Reports:

Outsourcing data and reporting services provides insurance companies with timely and comprehensive insights. These reports cover Submissions, Quotes, Issuances, Non-Renewals, etc., allowing decision-makers to stay informed, analyze trends, and identify areas for improvement.

Let’s understand with an example:For instance, by regularly monitoring insurance proposal rejection rates, carriers can pinpoint weak areas in their underwriting process and implement strategies to increase approval rates.

With real-time data at their fingertips, insurers can adjust their pricing strategies based on market demand and competitor behavior, ultimately leading to a competitive advantage.

Ensuring Transparency and Trust with Compliance and Regulatory Reporting:

The insurance industry is governed by strict regulations and compliance standards. Outsourcing reporting services enables companies to guarantee the creation of compliance and regulatory reports that align with industry guidelines.

This commitment to transparency builds trust with customers and regulatory bodies, showcasing the insurer's dedication to ethical practices and maintaining a strong reputation in the market.

Data Extraction and Ad-Hoc Reporting for Strategic Insights:

Outsourcing data extracts and ad hoc reporting opens the door to strategic insights that can transform your insurance business.

Marketing teams can leverage these reports to gain valuable insights into customer demographics and preferences. Armed with this knowledge, they can create targeted marketing campaigns, leading to higher customer acquisition and retention rates.

Besides, underwriters can also benefit from ad hoc reports as they gain deeper insights into risk profiles, enabling more accurate pricing decisions and improved profitability.

Make Informed Choices with Data-Driven Decisions:

Outsourcing data and reporting services lays the foundation for insurance companies to make informed, data-driven decisions. With access to comprehensive and up-to-date reports, decision-makers can assess market trends, customer behavior, and industry dynamics.

Data-driven decisions not only lead to increased profitability but also enable you to devise effective business strategies, identify growth opportunities, and fortify your business against uncertainties, providing the agility needed to navigate the dynamic landscape of insurance.

To Wrap Up

Data-driven decision-making is no longer a luxury but a necessity for insurance companies. Outsourcing data and reporting services enable carriers to make informed choices, anticipate market trends, and, ultimately, drive growth and success in the dynamic insurance industry.

Get in touch with us to outsource your data and reporting services and take your insurance business to new heights.

Recent Blogs

The AI FTE Approach to Property Risk Assessment

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization