The evolving digital age continues to raise customer expectations. With more customers expecting tailored communication and services, insurers are now exploring ways to automate and simplify their existing processes to reduce error rates, processing times, and overall costs.

In the insurance industry, where back-office operations are crucial for smooth policy administration, claims processing, and compliance management, robotic process automation (RPA) has gained traction as a transformative solution. By leveraging software robots to automate repetitive and rule-based tasks, RPA holds the potential to revolutionize insurance back-office operations, delivering enhanced accuracy, efficiency, and cost savings.

This blog covers in-depth details about how robotic process automation (RPA) can improve the entire back-end workflow and the various automation opportunities it offers.

Where can you implement RPA?

A recent study by McKinsey highlights that the insurance sector is expected to automate 50-60% of back-office functions by 2025, and RPA plays into a much broader trend of digitization industry-wide.

Keeping that in mind, RPA can be applied to various back-office processes and functions in the insurance industry, such as:

- Policy administration

- Claims processing

- Premium accounting

- Regulatory compliance

- Data management

How can it benefit P&C's Back-Office operations?

Traditionally, back-office operations in insurance involved manual data entry, document processing, and repetitive administrative tasks. These processes are not only time-consuming but also prone to human errors. With RPA, software robots can be programmed to perform these tasks precisely and quickly, eliminating manual intervention. RPA bots can seamlessly navigate different applications, validate information, update records, generate reports, and communicate with other systems or stakeholders by capturing and interpreting data from multiple systems.

The benefits of RPA in the insurance industry are manifold. Some of them are listed below:

- Enables significant time savings and improved efficiency by automating time-consuming tasks. It eliminates errors caused by manual data entry, ensuring data accuracy and integrity.

- Allows insurance professionals to redirect their focus from repetitive tasks to more strategic activities, such as customer service, claims analysis, and underwriting. This shift in workload allocation enhances employee productivity and improves the overall customer experience and satisfaction.

- Offers scalability and flexibility, enabling insurance companies to handle fluctuations in workload and adapt to changing business requirements more efficiently. Implementing RPA also results in cost savings by reducing the need for additional staffing or outsourcing routine tasks.

By harnessing the power of RPA, insurance companies can unlock new levels of efficiency, accuracy, and competitiveness in their back-office processes, ultimately driving enhanced business outcomes in today's dynamic insurance landscape

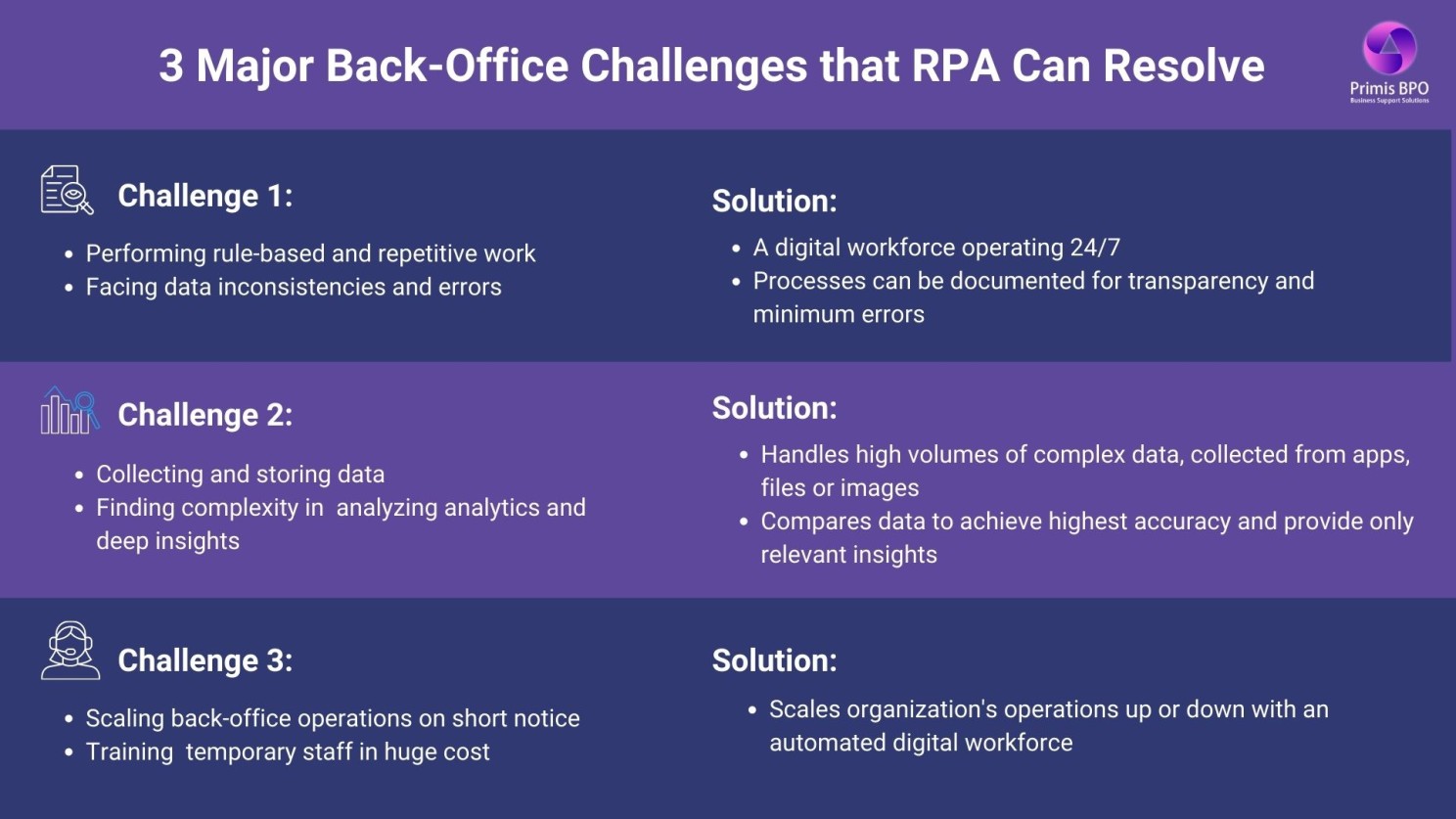

Challenges of Back-Office Automation

Most insurance providers are stuck in time-consuming back-office processes. The large volumes of repetitive business operations and manual tasks limit growth, the ability to deliver quality customer service and strategic competitive advantage.

For example, processing a claim requires collecting data from multiple sources, including policy administration systems and third-party systems, and saving it into one or more claims processing systems. Even if the insurer has digitized its records and data collection processes, tracking this information across virtual locations can be challenging.

Once the information is obtained, entering it manually takes time and can cause data-entry errors.

Automation can compensate for operational gaps and help reduce delays caused by human errors, offering insurance companies a competitive edge.

RPA can compile data from various sources and process it within a secure system. With the time saved, employees will have more availability to execute higher-value work like client engagement and identifying new business opportunities.

Automation Opportunities in P&C Back-Office Operations

RPA can be leveraged to improve the end-to-end experience and productivity of the P&C insurance staff by automating repetitive tasks and enabling them to focus on activities that add value to the organization.

Adopting RPA in insurance back-office operations offers significant opportunities for streamlining processes, reducing costs, and improving efficiency. Here are some specific back-office functions in the P&C insurance industry that can be effectively streamlined through RPA:

1. Improved Policy Administration

Policy administration involves various tasks such as data entry, policy issuance, endorsements, renewals, and policy documentation. RPA can automate these processes by extracting relevant information from multiple systems, generating policy documents, updating policy records, and ensuring data accuracy and consistency.

2. Accelerate Claims Processing

Claims processing is critical in insurance operations, involving evaluating, verifying, and settling insurance claims. RPA can automate repetitive tasks in claims management, such as data extraction, claim validation, and calculating claim amounts. It can also integrate with external systems to retrieve and analyze claim data, facilitating faster and more accurate claim processing.

3. Accurate Premium Accounting

Premium accounting encompasses premium billing, collections, reconciliation, and commission management. RPA can automate premium calculations, generate invoices, reconcile premium payments, and process commission payoutsto agents and brokers. Automating these tasks reduces manual errors, improves efficiency, and ensures timely and accurate financial transactions.

4. Effective Regulatory Compliance

Compliance with regulatory requirements is crucial for P&C insurance companies. RPA can assist in compliance management by automating regulatory reporting, monitoring compliance with data privacy regulations, and facilitating fraud detection. It can streamline processes related to recordkeeping, reporting, and regulatory audits, ensuring adherence to regulatory standards.

5. Enhanced Data Management

Data plays a vital role in insurance operations, and effective data management is essential for accurate decision-making and reporting. RPA can automate data entry, extraction, validation, and synchronization across various systems and databases. It can also facilitate data integration, cleansing, and migration, ensuring consistency and accessibility.

6. Efficient Document Handling

Back-office processes in insurance involve handling a large volume of documents, including policy documents, claim files, and legal agreements. RPA can automate document processing tasks such as scanning, indexing, data extraction, and document classification. It can also facilitate document retrieval, archival, and workflow management, improving accuracy and reducing manual effort.

Automation allows insurance providers to establish long-term solutions that can accelerate digital transformation and spur growth. By implementing RPA in these back-office processes, insurance companies can deliver efficiency and quality that build customer trust and loyalty. Insurers can identify the most suitable processes for automation and develop a comprehensive RPA strategy to maximize the potential of this technology in their back-office operations.

Get started with Primis. Our RPA experts will help you implement automation solutions to cater to your insurance back-office needs.

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence