Key Takeaways:

- Outsourcing FNOL (First Notice of Loss) allows insurers to focus on core operations.

- With a specialized team handling FNOLs, policyholders can receive quicker and more empathetic service during stressful times.

Imagine this: A storm just hit, and within minutes, the phones are buzzing in your insurance firm. Hundreds of policyholders are calling in, desperate for assistance after their homes and vehicles have been damaged. In that chaotic moment, how do you ensure each claim is handled swiftly, accurately, and with the empathy needed to maintain trust?

This scenario isn't just hypothetical—it's a reality that many insurers face regularly. The First Notice of Loss (FNOL) process is the crucial first step in turning these chaotic moments into organized and efficient claims resolutions.

But let's be honest: managing this process in-house can be a resource drain, diverting focus from your core mission.

With this, the blog explores how outsourcing FNOL can transform the claims process, making it faster, more efficient, and ultimately more customer-centric.

Outsourcing as a Solution

That's where outsourcing comes in as a strategic advantage. By outsourcing FNOL, insurance companies are proactively elevating their claims process. Envision transforming those stormy moments into opportunities to shine, with a specialized team ready to handle every incoming call, verify details, and process claims with precision.

Outsourcing FNOL is about empowering your team to focus on what they do best while ensuring policyholders receive the timely and compassionate service they deserve. As client expectations continue to grow and the industry grows ever more competitive, the question isn't whether you can afford to outsource—it's whether you can afford not to.

6 Ways Outsourcing FNOL Services Can Accelerate Claims Efficiency

- FNOL Call Handling and Information Collection:

- Automated FNOL Data Entry and Validation:

- Streamlined Claims Triage by Experienced Teams:

- Consistent and Compliant Data Collection Practices:

- Efficient Handling of High-Volume Claim Periods:

- Enhanced Customer Interaction and Support:

Ensures that experienced agents handle initial claim calls. These experts are skilled in gathering comprehensive and accurate information from policyholders, which speeds up the claims process by reducing the need for follow-up calls and clarifications.

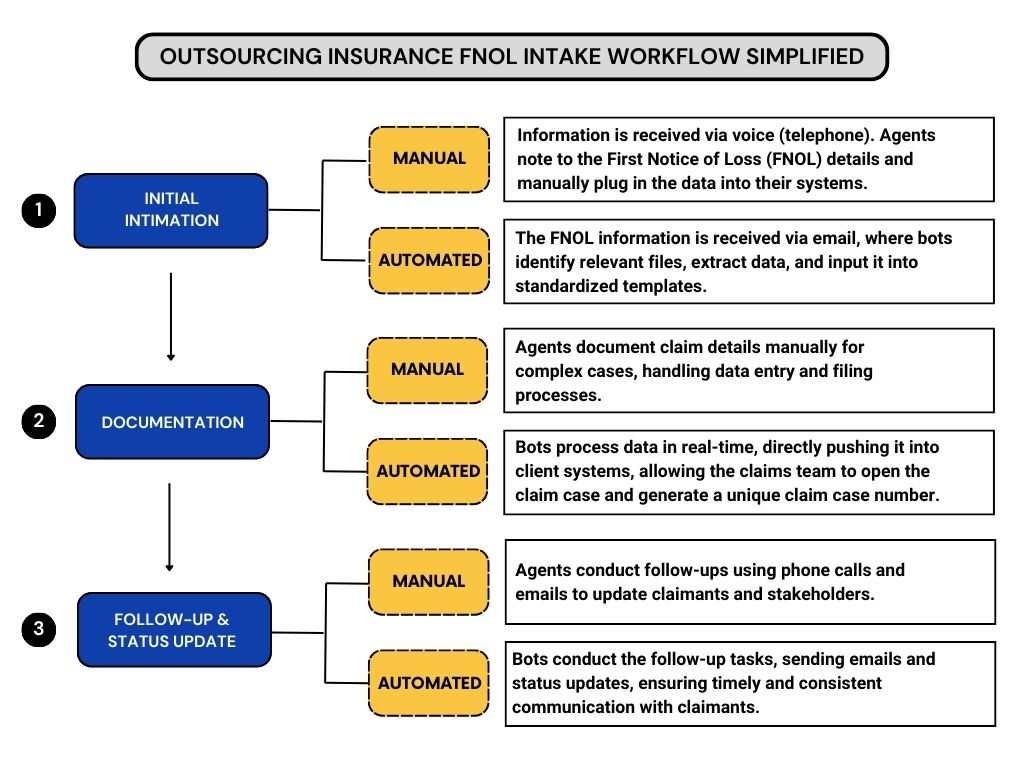

Utilizes advanced automation tools to handle FNOL data entry and validation, significantly reducing manual errors and processing time. Our team receives information from multiple sources and formats, such as Excel, PDF, and Word documents. Intelligent bots automatically identify relevant emails and instantly extract critical data from the initial FNOL submission, ensuring faster and more precise data processing. The extracted data is then entered into standardized templates and seamlessly transferred into the client's system, with any exceptions flagged for manual review.

Deploys teams dedicated to FNOL triage, which categorize and prioritize claims based on urgency and complexity. This expert triage ensures that high-priority claims are fast-tracked and complex cases receive the attention they need, accelerating overall claims processing.

Adheres to standardized FNOL data collection practices and compliance protocols. This consistency ensures that all necessary information is gathered correctly from the outset, reducing the risk of errors and subsequent delays in the claims process.

Allows insurers to handle spikes in claim volume effectively, such as during natural disasters or major events. Specialized FNOL providers can scale their operations rapidly to accommodate increased demand, ensuring that every claim is processed swiftly without straining the insurer's internal resources.

Provides high-quality customer service during the initial claim/FNOL interaction. Their ability to empathetically handle policyholders' concerns and provide clear guidance ensures a smoother claims experience, which helps in reducing delays caused by confusion or dissatisfaction among claimants.

A Strategic Approach to Outsourcing FNOL Intake

Adopting a strategic approach to outsourcing FNOL (First Notice of Loss) intake can significantly enhance operational efficiency and accuracy in claims processing. By carefully selecting and managing external partners, insurance companies can streamline workflows, reduce costs, and improve customer satisfaction.

Summing up with Statistical Insights

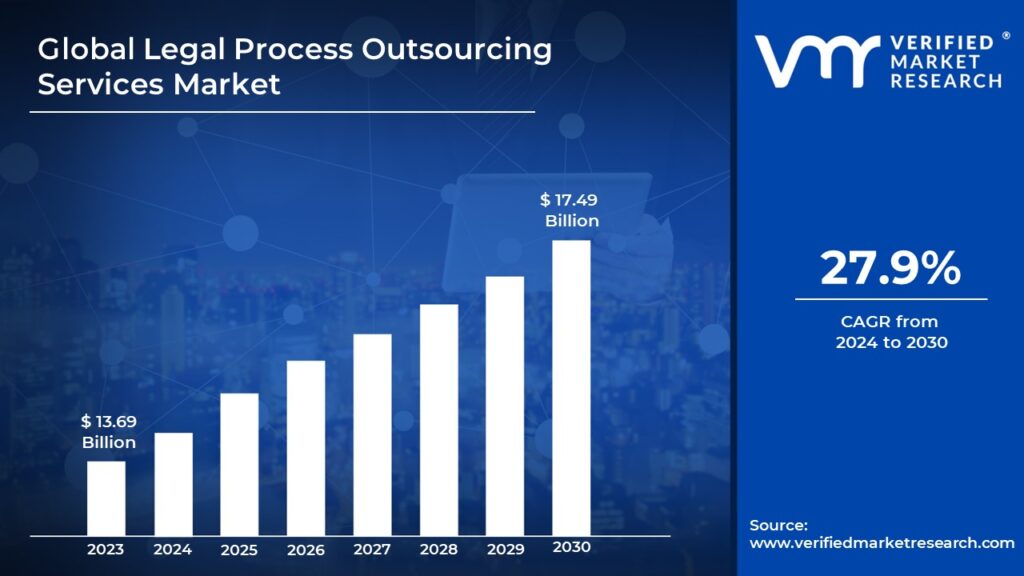

Statistics reveal that the Insurance BPO Services Market size is estimated at USD 7.08 billion in 2024 and is expected to reach USD 8.94 billion by 2029, growing at a CAGR of 4.76% during the forecast period (2024-2029). This highlights the growing trend of insurers increasingly opting for insurance outsourcing to enhance operational efficiency, streamline FNOL processes, and meet rising customer demands.

Wrapping Up

Outsourcing the FNOL process empowers insurers to enhance efficiency and provide exceptional service to policyholders. By partnering with Primis BPO, insurers can streamline claims intake, improve customer satisfaction, and focus on core business activities.

At Primis, we specialize in delivering seamless FNOL support that integrates effortlessly with your team, ensuring professionalism, empathy, and efficiency throughout the claims process. With us, insurers can maintain a policyholder-centric approach while staying competitive in a fast-evolving market. Reach out to us today to discover how our tailored FNOL services can drive your business forward.

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence