Insurance business owners juggle many tasks, from managing operations to keeping track of financial transactions. Perhaps hiring an in-house bookkeeping professional could be an option, but their related expenses could be overwhelming.

Another option could be handling your bookkeeping yourself, believing it's a cost-effective solution. But have you got the time to do it?

Well, if you find yourself nodding along, then it’s time for you to find a solution.

Navigating the Challenges

In the initial stages, it's tempting to believe you can handle all aspects of your insurance business operations, including bookkeeping. After all, who knows your business better than you, right?

However, as your business expands, so do the complexities of your financial tasks:

1. Managing irregular cash flow due to the fluctuating nature of premium payments and claims settlements.

2. Handling complex commission structures for brokers and agents requires meticulous attention to detail.

3. Addressing discrepancies between actual and projected loss reserves necessitates thorough analysis and adjustment.

4. Navigating the complexities of reinsurance arrangements and accurately recording premiums, claims, and recoveries.

5. Dealing with policy cancellations, endorsements, and reinstatements while maintaining accurate records.

Outsourcing your insurance bookkeeping services relieves you of the tedious tasks and also slashes costs associated with hiring in-house personnel, training, and technology infrastructure.

Now, let’s take a look at how it helps!

Top 6 Reasons to Outsource Your Insurance Bookkeeping Services

Streamline records: Categorizes financial transactions related to claims payments, reserves, and settlements. This efficiency reduces processing time, minimizes errors, and improves customer satisfaction by ensuring timely and accurate claims handling.

Manage premium collections: Manages accounts receivable for premium collections, ensuring that payments are collected promptly and accurately recorded in the general ledger. This helps maintain a steady cash flow for your insurance business and reduces the risk of delinquencies or revenue leakage due to ineffective collection processes.

Analyse loss ratio: Provides access to specialized expertise in analyzing loss ratios, a critical metric for insurance companies. By examining the relationship between premiums earned and claims incurred, outsourcing partners can offer valuable insights into underwriting profitability, pricing strategies, and risk management practices.

Track loss reserves: Ensures precise recording and tracking of loss reserves, enabling you to make informed decisions about reserve adequacy, pricing adjustments, and capital allocation to strengthen your financial position and maintain solvency. This also helps to maintain adequate funds to cover future claim payments.

Manage policyholder equity: Assists in managing policyholder equity accounts, including dividends, surplus distributions, and policyholder loans. Outsourcing ensures accurate calculation and allocation of policyholder equity, fostering transparency and trust among policyholders while optimizing capital utilization and supporting long-term financial stability for your insurance business.

Understanding with Stats

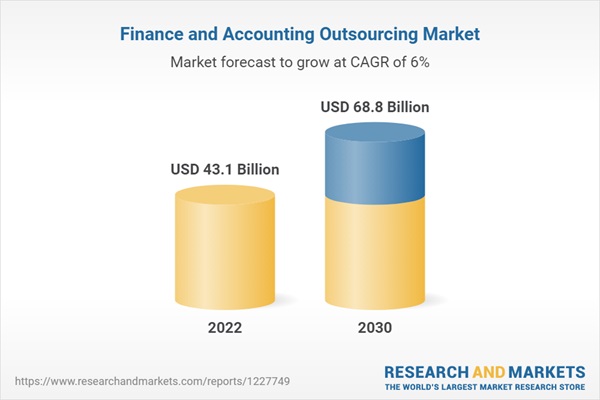

According to a recent report by Research and Markets, ‘the global market for Finance and Accounting Outsourcing, estimated at US$43.1 billion in the year 2022, is projected to reach US$68.8 Billion by 2030, growing at a CAGR of 6% over the analysis period.’

These numbers speak volumes about the growing trend towards outsourcing financial tasks.

Having said that, are you still hesitant to outsource due to common misconceptions swirling around the practice?

No worries; let us debunk those myths and embrace the undeniable benefits of outsourcing your insurance bookkeeping needs.

Myth-Busting: Exploring the Reality of Outsourcing Bookkeeping Services

Myth 1: Loss of financial control

Contrary to popular belief, outsourcing your bookkeeping doesn't equate to losing control over your finances. Here's why:

-

Partnership approach: Offers customizable service levels to suit your preferences, acting as strategic partners invested in your business's success.

-

Transparent communication: Ensures you remain informed about your financial status with regular updates and open communication.

Myth 2: Outsourcing is expensive

Commonly, there's a misconception that outsourced small business bookkeeping services come with a hefty price tag. However, this notion could not be further from reality. In fact, outsourcing can be an incredibly cost- efficient solution. Here's why:

-

Access to a talent pool worldwide: Taps into a diversified talent pool, helping you find the best fit for your needs, regardless of location.

-

Pay for results: Pay for the work completed, eliminating concerns about overhead costs associated with in-house hires.

Myth 3: Lack of real-time financial data access

Another misconception is that outsourcing limits your access to real-time financial data. However, modern technology and expert handling ensure:

-

Technology integration: Enables seamless access to financial data anytime, anywhere, with advanced tools and skilled professionals.

-

Enhanced accessibility: Offers superior access to financial data compared to in- house teams.

Myth 4: Increased risk exposure

Some believe that outsourcing poses greater risks compared to an in-house team. However, outsourcing can actually mitigate risks:

-

Error prevention: Reduces the risk of accounting errors, while stringent security measures safeguard sensitive financial data.

Myth 5: Difficulty finding a reliable provider

Finding a reputable outsourced bookkeeping service doesn't have to be challenging:

-

Abundant options: Provides efficient services, often exceeding the capabilities of in-house teams.

-

Research and recommendations: Conducts thorough research, seeks recommendations, and explores online reviews to identify suitable providers.

Myth 6: Small businesses don't need outsourcing

Outsourcing benefits small businesses just as much as larger enterprises:

-

Efficiency and expertise: Outperforms in-house support, saving time and resources.

-

Scalable solutions: Eliminates the need for hiring and training additional staff, providing flexible support as your business grows.

Concluding Thoughts

Embracing BPO bookkeeping services is a transformative move for insurance businesses aiming for accounting excellence. By outsourcing bookkeeping tasks to experts, insurers can streamline operations, reduce costs, and unlock invaluable insights for informed decision-making.

This enhancement in accounting efficiency unleashes the potential for carriers to concentrate on their value-adding tasks while leaving the complexities of bookkeeping to skilled professionals, ultimately paving the way for sustained success in today's dynamic economic landscape.

Thinking of outsourcing your accounting services? Talk to us today! We will handle the rest.

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence