Brokers and underwriters can no longer count on passing paper around the office or turning to a co-worker sitting next to them for missing information. Streamlining activities like straight-through processing and continuous underwriting require uninterrupted real-time data access to assess complex risks quickly. However, much of this data is trapped in digital insurance documents of different types and formats, and almost 80% of it is unstructured, as per a report by medium.

In this blog, we will explore the importance of submission intake in the insurance industry and the challenges insurers face in the submission intake process. We will also provide an overview of how outsourcing can help address these challenges. Along with this, we will elaborate on how outsourcing submissions intake can reduce costs, improve accuracy, and speed up the process.

The Current State of Submissions Intake

Despite technological advancements, a substantial portion of insurers continue to navigate the complexities of paper-based submissions, introducing inefficiencies and delays into their processes.

-

Diverse Data Formats

Insurers deal with many document types and structures, ranging from PDFs and spreadsheets to structured forms, making it difficult to establish a standardized and streamlined intake process.

-

Unstructured Data Complexity

Insurers face the daunting task of transforming unstructured data into actionable insights, often resulting in processing bottlenecks.

-

Operational Inefficiencies

Manual data entry, document verification, and coordination among stakeholders contribute to delays in the submissions intake workflow, preventing insurers from responding swiftly to evolving market dynamics.

As insurance companies are facing these challenges, it becomes imperative to explore innovative solutions that address current limitations and pave the way for a more efficient and resilient submissions intake process.

Outsourcing Submissions Intake: A Strategic Paradigm Shift

Insurance companies are increasingly turning to outsourcing as a strategic imperative. This section delves into the manifold benefits of outsourcing this critical function, supported by empirical evidence, and elucidates key considerations for insurers contemplating this transformative approach.

Benefits of Outsourcing Submissions Intake:

- Outsourcing partners are proficient in data extraction and document management, helping insurers achieve significant gains in operational efficiency and scalability.

- Outsourced providers often operate on economies of scale, offering cost-effective solutions compared to in-house processes.

- Outsourcing partners often invest in the latest technologies, such as ML and optical character recognition (OCR), enabling insurers to transform unstructured data into actionable insights.

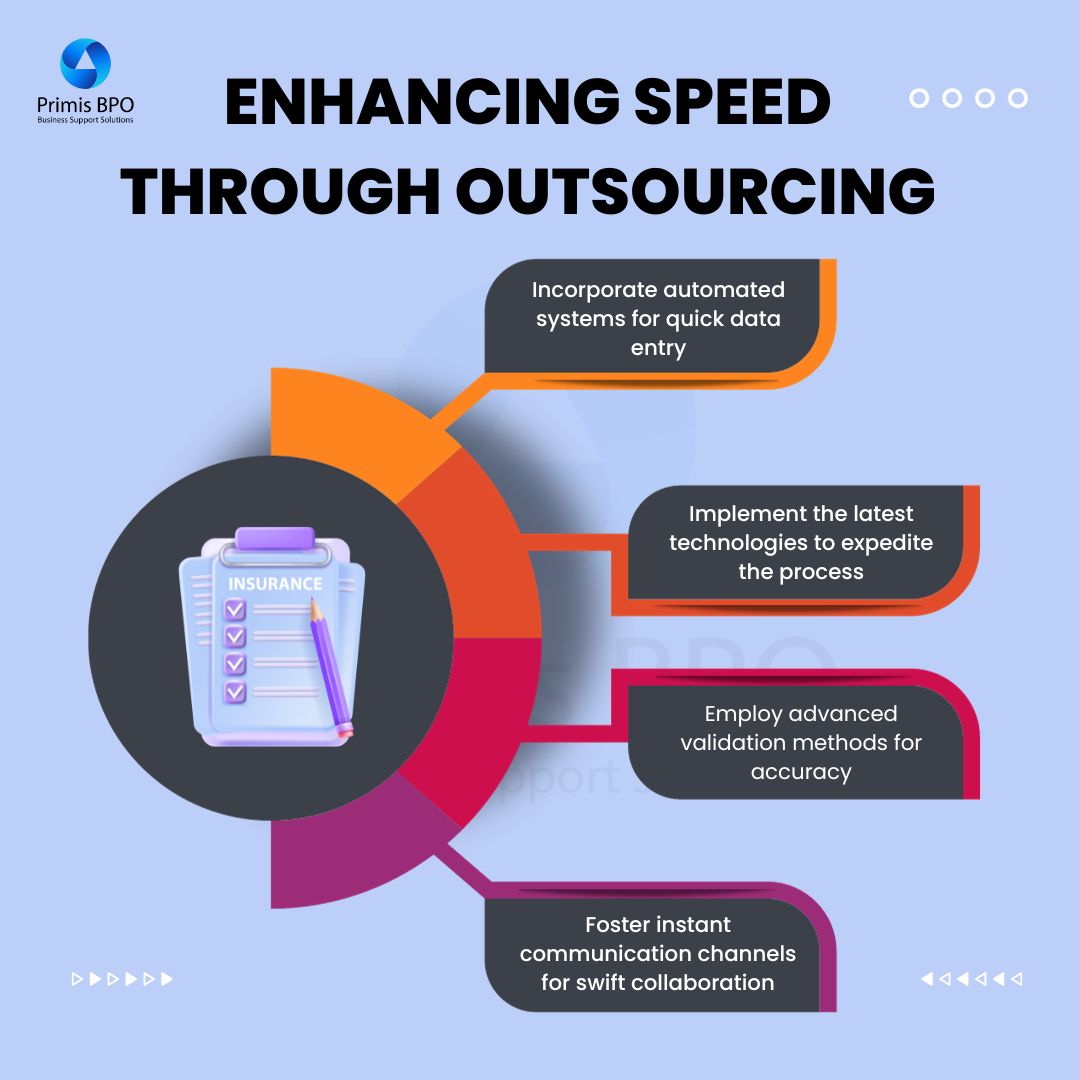

Enhancing Accuracy through Outsourcing

When it comes to outsourcing, ensuring quality is a major concern for businesses. Here are some quality control measures that can be implemented to enhance accuracy:

A. Quality Control Measures

Digital Transformation Diversification:

-

Follow a two-step verification process where data undergoes scrutiny.

- Utilize cross-validation checks to catch discrepancies and inconsistencies.

Training for Outsourced Teams Continuously:

- Regular training programs to keep outsourced teams abreast of industry updates and evolving standards.

- Conducting mock scenarios to sharpen their skills in identifying and rectifying errors.

B. Utilizing Advanced Technologies for Error Detection

AI and Machine Learning Applications:

- Integrate Artificial Intelligence (AI) to identify patterns and anomalies in data.

- Leverage ML algorithms for real-time data validation and minimizing errors.

C. Choosing the Right Outsourcing Partner

When it comes to outsourcing, choosing the right partner is crucial for the success of your business. Here are some steps you can take to ensure that you make the right choice:

Assessing the needs of your insurance submissions intake:

- Identify the pain points in your current process to understand what you need from an outsourcing partner.

- Define performance metrics to keep track of the progress.

Evaluating potential outsourcing partners:

- Look for partners who have experience working with companies in your industry.

- Check for necessary technology to support your needs.

- Ensure essential security and compliance measures are in place.

Conclusion

Outsourcing can help you focus on your core competencies and reduce costs, while still ensuring that your insurance submissions intake process is efficient and effective. By following the steps outlined in this blog post, you can make an informed decision about outsourcing and choose a partner that will help you achieve your business goals.

Connect with an experienced outsourcing partner like Primis today.

Recent Blogs

The AI FTE Approach to Property Risk Assessment

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization