Brief Summary: The importance of strategic outsourcing in insurance quote generation is undeniable. This blog highlights how outsourcing coupled with advanced technologies can simplify the process.

In today's dynamic insurance landscape, where competition intensifies and customer expectations soar, staying ahead doesn’t mean just offering the best coverage—it's more about efficiency, accuracy, and the ability to adapt swiftly.

Amidst this landscape, the role of outsourcing quote generation services emerges as a strategy that could transform this process, leading to streamlined operations, enhanced productivity, and increased cost-effectiveness.

With that, this blog will explore how outsourcing can simplify quote generation services, uncovering best practices for implementation.

How Can BPOs Help MGAs to Simplify Quote Generation via Outsourcing?

Outsourcing can fundamentally alter the way companies approach quote generation in the insurance sector, which is one of the critical aspects of their operations. This streamlines the process for insurers to gather vital information from leads, swiftly offering them cost approximations. By eliminating the need for agent calls or in-person meetings, prospects can conveniently obtain payment estimates.

By entrusting this task to third-party providers, they can tap into expertise and resources that enhance efficiency and accuracy. These outsourcing providers, like Primis BPO, stand out as a reliable partner capable of seamlessly replicating a company's as-is processes, ensuring continuity and consistency. Leveraging our expertise and strong domain understanding amplifies the benefits, particularly in reducing turnaround times and streamlining workflows.

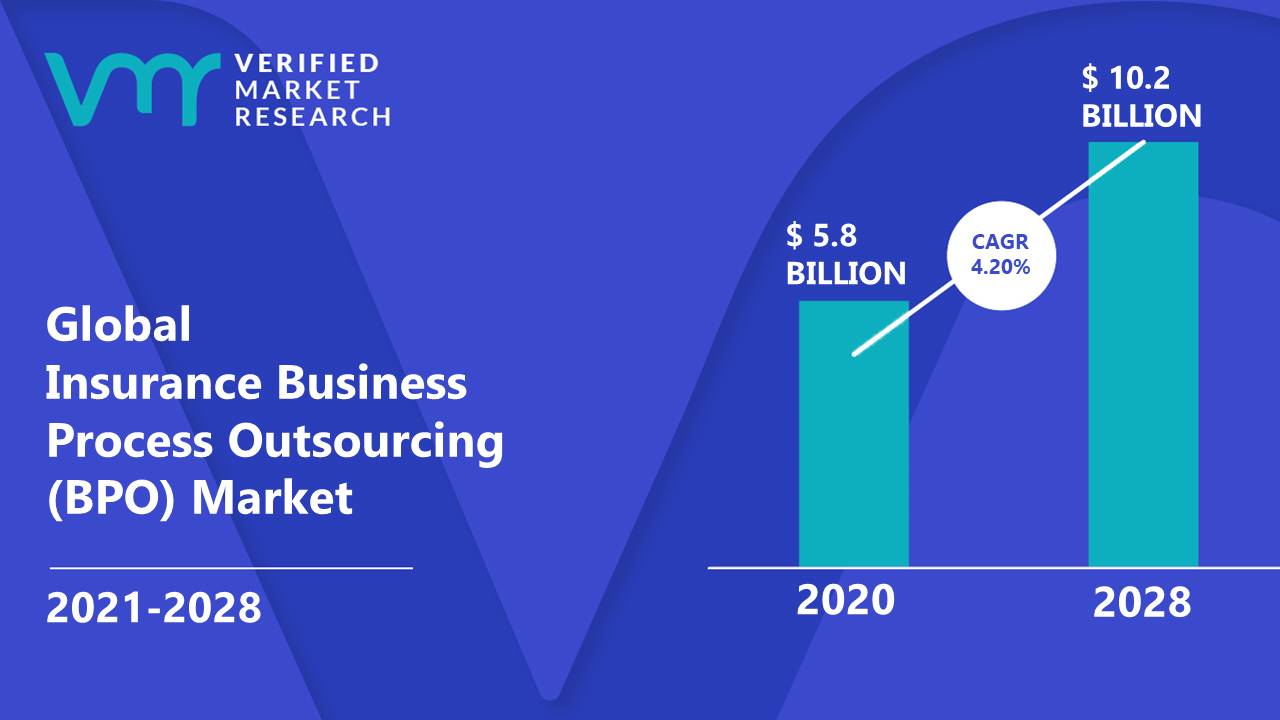

Numbers that Speak Volumes

According to recent studies, insurance BPO is on the rise, with a projected market value expected to reach US$10.2 billion by 2028, growing at a CAGR of 4.20% within the forecasted period.

Wondering about this exponential growth? Simple—it works. By outsourcing quote generation, businesses can:

- Reduce internal workload and free up valuable resources for core competencies

- Gain access to a broader talent pool & specialized skills

- Benefit from potentially lower costs and economies of scale

- Improve quote turnaround time

Let's understand with an example -

Suppose that a client needs multiple quotes tailored to their specific requirements. Compiling this in-house could take days if not weeks. However, with an outsourced team dedicated solely to this task, the same results can be delivered within hours without compromising accuracy or quality.

In a Nutshell

As highlighted throughout this blog, the benefits of outsourcing quote generation are undeniable: enhanced efficiency, heightened accuracy, and greater adaptability. By entrusting this critical function to reliable BPO firms, insurance providers can not only optimize their operations but also unlock new growth avenues and innovation.

As we look to the future, it's evident that those who embrace outsourcing will be better positioned to navigate the market complexities and emerge as industry leaders.

Are you planning to outsource your insurance tasks to an external provider? Reach out to Primis BPO for reliable solutions.

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence