In a world where time is money and efficiency reigns supreme, the complexities of claims processing have long been a thorn in the side of insurance businesses. The traditional in-house claims processing approach often comes with its fair share of bottlenecks – lengthy processing times, convoluted workflows, and a higher risk of errors. It's no wonder organizations are turning their gaze towards outsourcing as a beacon of efficiency.

But hold on to your seat because there's a game-changing solution – outsourcing claims processing. Yes, you read that right! The convergence of advanced technology and expert human touch is revolutionizing how insurers handle their claims, offering seamless solutions that were once thought to be a distant dream.

As per recent reports, many businesses are still struggling with traditional, in- house claims processing methods. These outdated approaches not only drain resources but also lead to a staggering increase in processing time, leaving customers frustrated and bottom lines bruised. It's no wonder that smart enterprises are turning to outsourcing for a breath of fresh air. In fact, according to a recent study, the global outsourcing market is projected to grow at a jaw-dropping US$904.9 billion by 2027.

But this isn't just a numbers game; it's a narrative of transformation. Imagine an insurance company that managed to slash its claims processing time by half - thanks to a specialized team that works around the clock. This is not a mere fantasy; it is a tangible outcome of harnessing the power of outsourcing.

This blog will delve into how leveraging outsourcing can effectively address conventional bottlenecks and amplify the efficiency of claims processing.

Leveraging the Synergy of Outsourcing and Technology: 6 Efficient Ways to Optimize Claims Processing

Operational Efficiency through Task Segmentation:

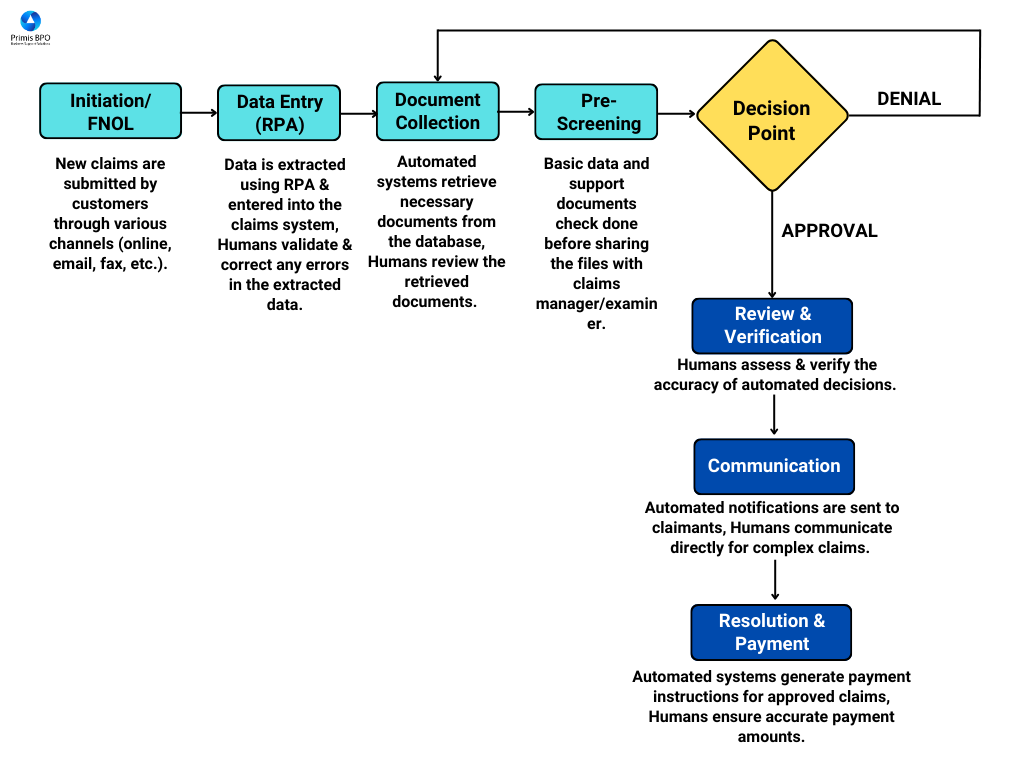

Outsourcing allows insurers to delegate specific tasks within the claims processing workflow to specialized external teams. With automation integrated into the outsourced tasks, repetitive and rule-based processes like data entry, document verification, and initial claim assessment can be streamlined. This division of labor within outsourcing partners and automated systems ensures each component focuses on what they do best, leading to faster and more accurate claims handling.

Data-Driven Decision Making:

Automation contributes to data accumulation and analysis. By harnessing data analytics, insurance companies can identify patterns, trends, and potential fraud indicators in claims. The combination of outsourcing and automation enables insurers to tap into specialized analytics expertise offered by external partners. This collaborative effort ensures that decisions are data-driven and mitigates risks associated with fraudulent or irregular claims, resulting in improved accuracy and cost savings.

Continuous Process Improvement:

Outsourcing claims auditing to external firms can be integrated with automation tools that perform regular audits on a sample basis. By analyzing a subset of processed claims, these tools can identify potential discrepancies or errors, which the external auditors can then investigate further. This cooperative approach ensures that the outsourced team continuously improves its accuracy and compliance, benefiting from the insights provided by automation.

Claimant Communication:

Outsourcing claimant communication streamlines customer interaction. Automated chatbots can handle routine inquiries, offer instant status updates, and guide claimants through required documentation submissions. Besides, human agents can manage complex inquiries. This combination ensures consistent and timely communication, reducing customer frustration and improving satisfaction.

Sequential Approach to Streamlining Claims Processing with Outsourcing and Technology Integration

A Future of Claims Excellence

As we bring our journey through the realm of claims processing towards its end, one thing is clear: outsourcing has unleashed a new era of efficiency and excellence in the insurance industry. The days of prolonged processing periods and frustrated policyholders are fading into the past, making way for a streamlined future.

As the digital age propels us forward, it's time to reinvent claims processing. It's time to harness the power of outsourcing and reshape the insurance landscape. The future is here, and it's seamless, efficient, and waiting for those bold enough to embrace it.

So, whether you're seeking to stay ahead of the curve or a newcomer looking to make your mark, Contact us to outsource your claims processing. We will take care of the rest!

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence