In the bustling world of business, efficient billing management emerges as a crucial factor in driving growth and financial stability. According to recent reports, most small businesses are responsible for handling their own billing processes, diverting valuable time and resources away from their core operations.

Unveiling the Challenge

The intricate web of P&C insurance demands efficient management of premium collections (Accounts Receivable) and timely vendor payments (Accounts Payable). From handling policyholders' payments to disbursing claims to external vendors, every step requires meticulous attention. Yet manual processes, legacy systems, and human errors often lead to delays, inaccuracies, and frustrated stakeholders. The repercussions are far-reaching: compromised financial stability, hindered customer satisfaction, and even reputational damage.

The Way Out

But there's a better way—an innovative approach that liberates businesses from the shackles of administrative drudgery and empowers them to soar toward their goals. Enter outsourcing, a strategic move that has been proven to unlock numerous benefits for P&C insurance companies. As per Globe Newswire, Revenue in the outsourcing market is expected to grow at a CAGR of 7.09% from 2022 to 2029, reaching nearly USD 293.650 Billion.

Statistics reveal that outsourcing the AR and AP processes can significantly boost the accounting division's performance. With a whopping two-thirds of businesses citing cost savings as the prime advantage of outsourcing, this method of management yields tangible results. Moreover, the turnover threats that often plague in-house operations can be thwarted through the smart decision to outsource, allowing businesses to channel their resources toward growth- oriented activities.

This blog will explore how outsourcing accounts receivable (AR) and accounts payable (AP) processes will enhance efficiency in P&C insurance businesses.

Enhancing Financial Agility: 6 Key Benefits of Outsourcing Accounts Payable and Receivable Processes

Advanced Technology Integration

-

Leverage advanced technological infrastructure that outsourcing providers often possess in order to seamlessly integrate with your company's existing systems.

-

Use automated invoice processing, data analytics, and AI-driven tools for predictive financial analysis. By leveraging these, businesses can gain deeper insights into their financial operations, identify trends, and make data-driven decisions, reducing manual errors and accelerating the entire billing process.

Resource Optimization

-

Relieve the burden of maintaining and upgrading systems, saving businesses significant costs.

-

Eliminate the need to hire and train additional staff for these tasks.

-

Empower your business to scale efficiently, dedicating their resources to areas directly contributing to growth.

Compliance Adherence and Risk Mitigation

-

Ensure meticulous compliance, as outsourcing providers are well-versed in insurance regulations.

-

Navigate intricate insurance-specific regulations, reducing the risk of compliance violations, penalties, or legal issues, thereby bolstering their risk management strategies with these experts.

Enhanced Vendor and Customer Relationships

-

Involve dedicated teams that specialize in vendor and customer interactions.

-

Engage proactively with suppliers and clients, resolving queries, addressing concerns, and ensuring timely payments and collections.

-

Foster stronger relationships, leading to better deal negotiations and a positive rapport with stakeholders.

Claims Processing Efficiency

-

Expedite the processing of claims-related payments and manage receivables from policyholders.

-

Enhance customer experiences but also contribute to faster claims resolutions, reducing administrative bottlenecks and enabling insurers to deliver on their promises efficiently.

Improved Cash Flow Management

- Streamline invoicing, payment processing, and collections, leading to faster transactions and improved cash flow.

- Empower your business to make strategic decisions, invest in growth initiatives, and seize opportunities without being hindered by cash flow constraints.

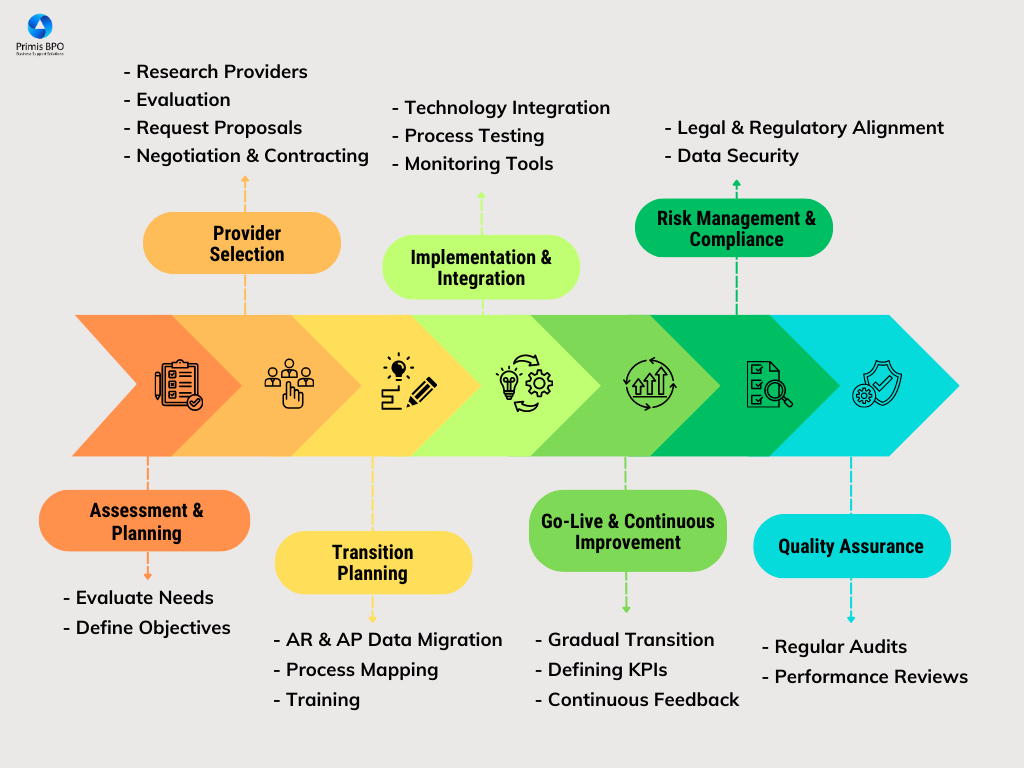

Step-by-Step Guide to Outsourcing Accounts Payable & Receivable Processes

Wrapping Up

Embracing the power of outsourcing for Accounts Receivable and Payable processes isn't just a decision—it's a transformative leap toward efficiency, growth, and adaptability. By entrusting specialized partners to handle the intricacies of billing, companies can focus on their core objectives and navigate the challenges of today's competitive world with newfound agility. It's not just about streamlining—it's about unlocking a brighter future.

Get in touch with us to transform your accounts receivable and accounts payable processes!

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence