Imagine a world where insurance is just a few taps away and customers enjoy seamless experiences without any hassle. Well, thanks to digital technology, this is now a reality in the P&C insurance industry. As customer expectations continue to evolve and competition intensifies, insurers face a crucial challenge: how to leverage advanced technology to meet changing customer demands and elevate their satisfaction levels?

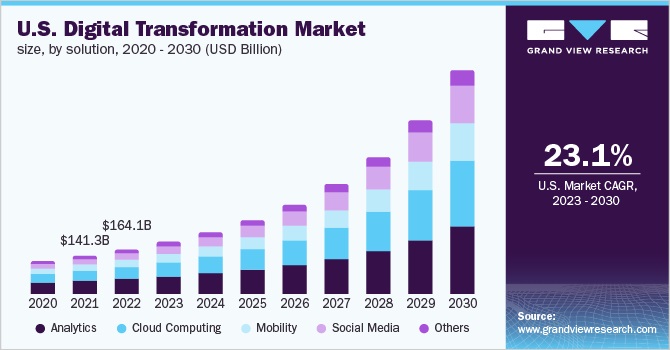

Digital transformation is here—a game-changer technology, capable of revolutionizing the P&C insurance landscape, making it more responsive, efficient, and customer-centric than ever before. Surprisingly, according to a recent report, the global digital transformation market size was evaluated at USD 731.13 billion in 2022 and is anticipated to witness a CAGR of 26.7% from 2023 to 2030.

Being said that, a significant question arises: How exactly can insurers leverage this transformation to drive customer retention?

Here are a few options:

Which of these digital transformation strategies holds the most promise for P&C insurers in terms of accelerating customer retention? Let’s read on!

How is Digital Transformation in BPO Reshaping the P&C Insurance Industry?

Digital transformation in the BPO industry is revolutionizing the P&C insurance sector by driving efficiency, innovation, and customer-centricity. BPO companies leverage digital technologies such as AI, automation, and analytics to streamline claims processing, improve underwriting accuracy, and enhance customer experiences. By automating repetitive tasks and leveraging data insights, insurers can expedite claims settlement, offer personalized products, and optimize risk assessment. This transformation enables insurers to:

- Adapt to evolving customer demands

- Reduce costs

- Deliver seamless services

Moreover, through digital transformation, BPOs enable data-driven decision- making, leveraging advanced analytics to extract insights from vast data sources. This empowers insurers to make informed strategic choices regarding risk assessment, product development, and marketing campaigns, resulting in personalized insurance solutions and improved customer satisfaction.

Let's explore some real-life scenarios that highlight the impact of digital transformation in the insurance sector:

These instances exemplify streamlining processes and personalizing customer experiences throughout the policy lifecycle; insurers can strengthen their relationships with customers and become the "insurance heroes" they seek.

Top 5 Ways Digital Technologies Drive Transformation in the P&C Industry

Consolidation of BPO Back-office and Front-end Processes

- Digital transformation is crucial for all business processes to achieve success, yet many companies focus solely on transforming front-office operations, neglecting the fundamentals of the back-office. This quickly leads to deceleration, where growth comes to a halt.

- Back-office outsourcing entails internal processes such as document digitization, and front-end process outsourcing is customer-facing, like contact center operations, etc. Digital transformation is pushing organizations to intertwine back-office and front-end processes, eliminate silos, connect various processes, automate them, and leverage data to serve a common goal.

- For example: digitizing paper documents used to be a back-office process. However, as data is vital for several core front-end processes, digitizing paper documents is becoming an essential goal - providing an enhanced customer experience and ultimately impacting the bottom line.

The Significance of Customization for BPOs

- As operations and business processes transform through intelligent workflows, businesses must incorporate various emerging technologies to stay relevant and foster growth.

- This necessitates a shift towards more tailored and intelligent business process outsourcing, accommodating the unique requirements of customers for increased client retention.

- To achieve this, the BPO industry must evolve beyond traditional service providers and embrace digital transformation to become capable of providing diverse capabilities as per customer demands.

AI’s Transformational Impact across the Entire BPO Chain

- AI technology has revolutionized the digital landscape in areas like speech recognition, machine learning, natural language processing, etc.

- In the BPO industry - it's expected that more and more intelligent solutions like chatbots will replace the traditional FAQs or helpdesk; automated ML- based workflows will support tasks such as staff scheduling, etc., further enhancing efficiency.

- The role of the BPO industry is increasingly becoming crucial in ensuring improved customer experiences and streamlined digital channels. AI algorithms enable precise data collection, resulting in faster and more accurate solutions for customer queries.

BPO Companies are Shifting towards an Omnichannel Approach

- The BPO industry recognizes the significance of delivering a seamless omnichannel experience for enhanced client satisfaction.

- Inadequate customer service experiences can lead to lost opportunities and attrition. Exceptional service, with immediate response and zero wait times from knowledgeable staff, becomes crucial in winning over potential customers.

- To stay competitive, several businesses are increasingly adopting omnichannel strategies - aligning their branding, website design, and customer service channels to create a unified and cohesive customer experience.

BPO Process Optimization and Workflow Automation with Predictive Analytics

- The integration of predictive analytics allows businesses to analyze historical data and predict patterns, trends, and risks.

- Businesses utilize predictive analysis to improve process efficiency at every customer touchpoint. Organizations that can understand and analyze their data will likely gain a competitive edge.

- This approach offers a win-win scenario: it helps companies reduce costs by optimizing their operations while at the same time enhancing customer experience through proactive suggestions.

To Wrap Up

As the digital landscape continues to evolve, customers' expectations are increasing. They demand quick access to information and personalized services. Hence, digital transformation is becoming imperative for P&C insurance businesses. Failure to do so means limiting your ability to meet these expectations and risking customer attrition as they seek more convenient options.

Recent Blogs

The AI FTE Approach to Property Risk Assessment

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization