In the world of insurance, policy administration stands as the cornerstone of providing seamless and reliable coverage to customers. It encompasses many critical tasks, with premium analysis and policy renewals being two of the most vital components. As insurance companies strive to meet the market’s ever-changing demands while ensuring utmost customer satisfaction, streamlining policy administration has emerged as a game- changing imperative.

Insurance companies can achieve precise and competitive premium calculations by simplifying premium analysis. Furthermore, optimizing the policy renewal process enables insurers to retain valuable clients, foster lasting relationships, and unlock significant revenue opportunities.

Throughout this blog, we will walk you through the significance of streamlining policy administration, understanding the nuances of premium analysis and the complexities of policy renewals, and unveiling innovative strategies and technological advancements that pave the way for efficient and customer-centric policy administration.

The Importance of Streamlining Policy Administration

Policy administration involves a series of complex tasks that govern the entire lifecycle of an insurance policy, from issuance to renewal. Efficient policy administration encompasses a spectrum of benefits directly impacting an insurance company's success and reputation. It enables insurers to respond quickly to customer inquiries, provide accurate premium quotes, and simplify the renewal process.

Let's explore the significance of streamlining policy administration, with a specific focus on optimizing premium analysis and renewal processes:

1. Ensuring Regulatory Compliance

The insurance industry is subject to a myriad of regulations and compliance requirements. An efficient policy administration system ensures that all policies and procedures comply with the relevant regulations, enabling insurers to operate with confidence and transparency.

2. Minimizing Policy Lapses and Renewal Attrition

By streamlining the renewal process, insurers can proactively engage customers, offer competitive renewal terms, and tailor coverage to better suit their evolving needs. As a result, policyholders are more likely to renew their policies, boosting customer retention rates and revenue generation.

3. Improving Decision-Making and Risk Assessment

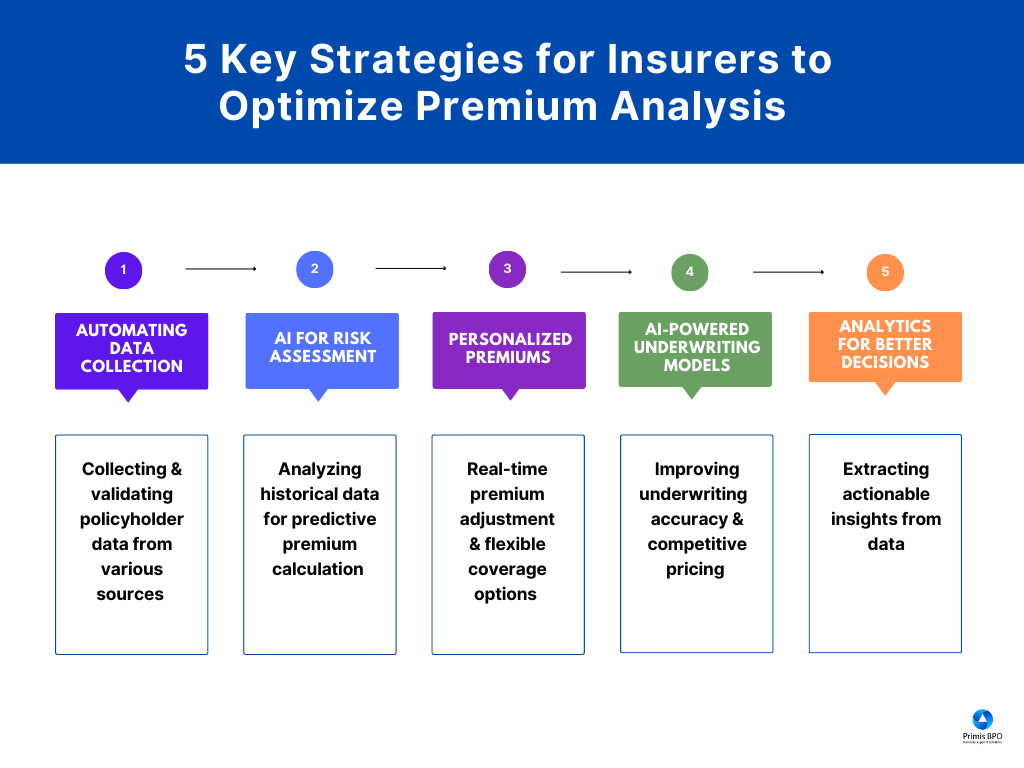

A streamlined policy administration system is based on robust data analytics and artificial intelligence. This empowers insurers to make data-driven decisions, accurately assess risks, and set optimal premium rates. By leveraging advanced technologies, insurers can identify trends, predict customer behavior, and offer tailored coverage, ultimately strengthening their underwriting capabilities.

Driving Success through Optimized Premium Analysis

A well-optimized premium analysis process ensures accurate and competitive premium calculations, directly impacting customer satisfaction and retention. Moreover, optimizing premium analysis empowers insurers to make data-driven decisions, identify growth opportunities, and optimize risk management strategies. This data-driven approach allows insurers to effectively assess their portfolio, identify high-risk policies, and take proactive measures to mitigate potential losses.

Streamlining Policy Renewals for Enhanced Customer Experience

The policy renewal process is a crucial phase in the insurance industry, representing a pivotal opportunity for insurers to retain valuable customers and foster enduring relationships. As insurers endeavor to optimize policy administration, streamlining the renewal process becomes a paramount goal to ensure seamless and efficient interactions with policyholders.

1. Early Engagement with Customers

Proactively managing policy renewals starts with early engagement with customers. This approach allows insurers to gain insights into changing needs and preferences, empowering them to provide personalized renewal options. Timely and proactive communication also enables insurers to address any concerns or queries, ultimately fostering a sense of loyalty among customers.

2. Predictive Analytics for Renewal Probability Assessment

By analyzing historical data, customer behavior patterns, and market trends, insurers gain a comprehensive understanding of their policyholders. This data-driven approach empowers insurers to identify at-risk policies. Consequently, insurers can optimize resource allocation and focus on policies with a higher probability of renewal, leading to improved customer retention rates.

3. Simplifying Renewal Documentation and Processes

By eliminating unnecessary complexities, insurers make it easier for policyholders to complete the renewal process efficiently. Digital self-service portals and automated reminders further streamline the journey, enabling customers to renew policies with minimal effort and enhancing the overall customer experience.

4. Incentives and Rewards for Renewal Customers

Recognizing and rewarding customer loyalty proves to be a powerful strategy for driving policy renewals. These incentives encourage policyholders to renew their policies and reinforce the insurer-customer relationship, fostering trust and satisfaction.

5. Embracing Technology for Efficient Renewal Management

By utilizing automated workflows and artificial intelligence, insurers can streamline the entire renewal journey, from personalized renewal offers to seamless policy issuance. Automation significantly reduces the risk of manual errors, allowing insurers to allocate resources to more value-added tasks and enhancing overall operational efficiency.

Conclusion

By leveraging data analytics, AI, and insurtech solutions, insurers can simplify premium calculations, enhance renewal strategies, and provide superior customer experiences. Efficient policy administration leads to increased customer satisfaction and improves operational efficiency and regulatory compliance, thus positioning insurance companies for long-term growth and success in the ever-evolving insurance market.

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence