In the fast-paced world of Property and Casualty (P&C) insurance, overcoming conventional challenges such as invoice delays and errors is crucial for operational excellence. Organizations are increasingly turning to innovative solutions, with Business Process Outsourcing (BPO) for a more streamlined and practical approach.

BPO billing solutions cover a spectrum of services critical to the invoicing process. From meticulous invoice creation to prompt sending and efficient payment processing, BPOs offer end-to-end solutions. The inclusion of collections services ensures that outstanding payments are handled with professionalism and diligence, further contributing to a more robust cash flow management strategy.

Benefits of Outsourcing Invoice Processing

Outsourcing your invoice processing can help you maximize operational efficiency. In this section, we've covered various benefits of outsourcing, from streamlined workflows and access to specialized expertise to freeing up your team for strategic tasks.

1. Efficient Invoice Processing

Effectively managing and processing invoices demands a significant investment of time and energy. By strategically outsourcing this responsibility to a proficient service provider, your team can concentrate on core business functions. This streamlines operations and opens up avenues for improved productivity and profitability, as key personnel can redirect their efforts toward strategic initiatives and revenue- generating activities. This approach optimizes the allocation of resources, fostering a more efficient and agile business environment.

2. Seamless financial workflows

Entrusting your invoice processing to external experts guarantees a seamless and timely financial workflow. These experts have a wealth of experience and ensure that your invoices are meticulously handled, minimizing the likelihood of errors and delays.

Moreover, these services incorporate robust quality control measures to uphold the highest standards of accuracy. By leveraging advanced technologies and best practices, outsourcing partners systematically review and verify each invoice, ensuring compliance with regulatory requirements and industry standards.

3. Resource Optimization

When processing your invoices in-house, chances are you will hire additional staff to handle the workload, elevating accounting and administrative costs. Collaborating with a proficient outsourcing provider that is well-versed in process optimization provides a strategic solution to curtail these financial outlays. The proficient handling of invoice processing by external experts frequently results in a noteworthy cost reduction.

4. Faster Turnaround Time

BPO providers bring specialized knowledge and experience, enabling them to optimize each step of the invoicing journey. This leads to faster invoice turnaround times, allowing businesses in the P&C insurance sector to expedite payment cycles and enhance overall financial agility.

BPO providers, armed with specialized knowledge and experience, optimize each step of the invoicing journey.

5. Maximize ROI

Unlocking a positive return on investment (ROI) in core operations can be challenging for many businesses. Often perceived as complex and less impactful, invoice processing gains greater chances for profitability and success when entrusted to a qualified outsourcing partner. Leveraging the expertise of an experienced provider ensures not only effective operations but also maximizes the ROI, positioning your P&C insurance business for sustained efficiency and success.

What’s the future?

Navigating the future of invoicing and outsourcing in the P&C insurance industry requires a keen eye on emerging technologies. AI and ML are set to reshape how we operate. AI-driven automation simplifies invoicing tasks, reducing manual work and boosting accuracy. Machine learning, with its knack for recognizing patterns, contributes to better predictions and decision-making.

Here are a few upcoming trends in invoicing and outsourcing:

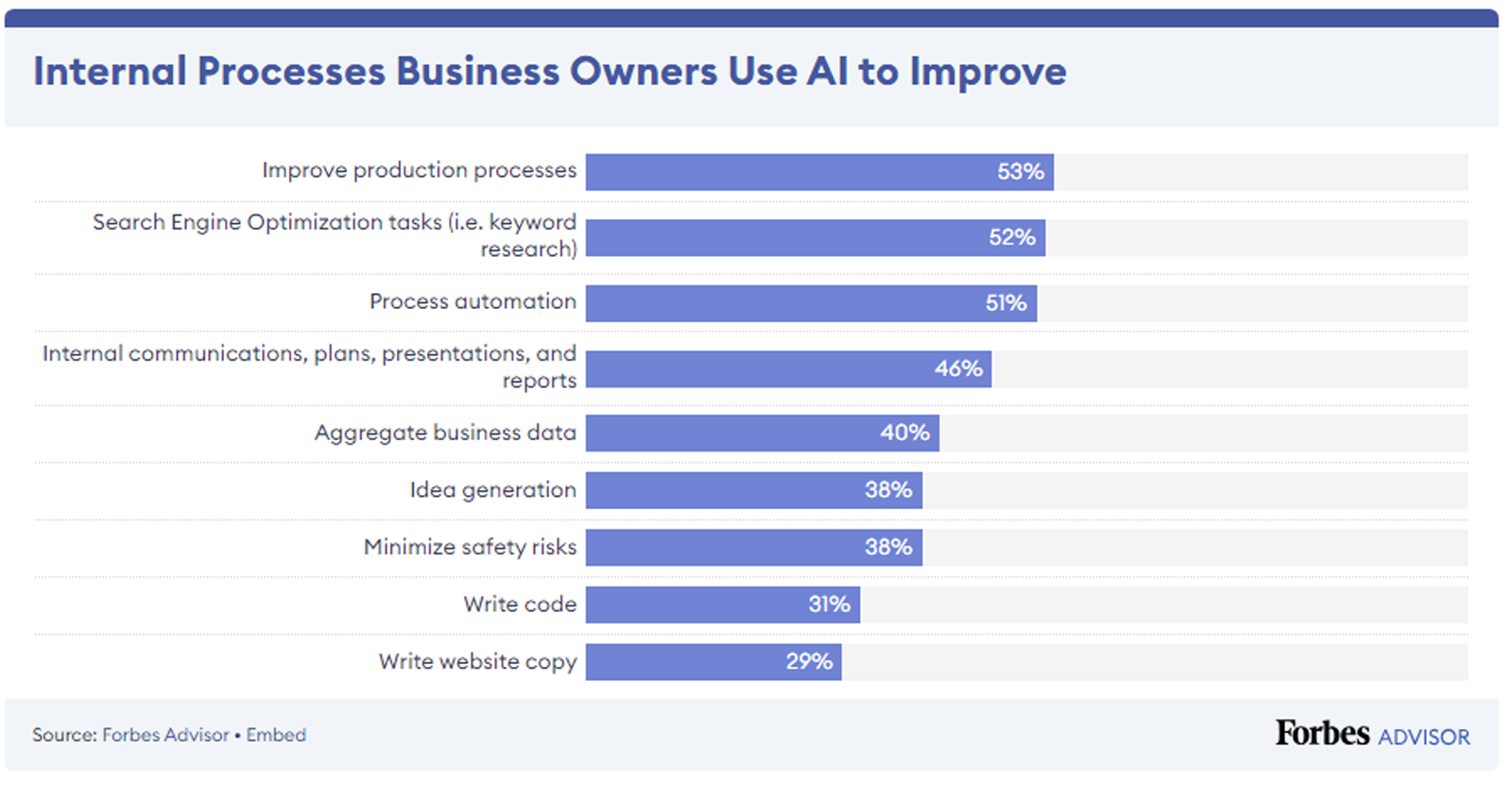

As per a Forbes Advisor Survey, 64% of businesses believe that AI will help increase their overall productivity, demonstrating the growing confidence in AI’s potential to transform business operations. Adopting these technologies not only streamlines processes but also gives P&C insurance businesses a competitive edge in the digital landscape.

Alongside these tech changes, industry standards for invoicing and outsourcing are evolving. Stricter rules and a stronger focus on data privacy are guiding the way. Embracing these upcoming trends puts businesses at the forefront of innovation, leading to transformative improvements in invoicing efficiency and compliance.

Conclusion

The transformation of invoicing processes through BPO services is a strategic move towards operational excellence. By harnessing the proficiency of BPO providers, P&C insurance organizations mitigate the risks of invoice delays and errors, streamline workflows for expedited turnarounds, elevate customer satisfaction, and ultimately optimize cash flow management. As businesses navigate the challenges of today's marketplace, embracing BPO solutions for invoicing emerges as a key driver for sustained success.

If you want to improve your business efficiency, consider outsourcing invoice processing to Primis BPO. Contact us today, and we’ll be happy to help.

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence