Nearly every insurance SME involves an accounting department that understands how time-consuming and tedious manual billing processing is. Do you know that it takes approximately one hour to process five bills manually? And the expense can be roughly anywhere from $14 to $30.

How many bills does your business process in a day? If your business is a small one, maybe less than 100. For bigger organizations, the chances are hundreds or even thousands.

Think of the amount of time your Accounts Payable team spends executing this tumultuous task manually, resulting in delays, errors, wasted time, and effort. How will your Accounts Payable teams keep up the pace? Forget about the delivery deadlines. Are these bills even accurate enough to ensure that you don’t have to repeat another entire new cycle of the billing process?

If your answers are unfavorable to the above questions or if you have overlooked these crucial business aspects, it is time to revamp the conventional processes and embrace technology. Welcome to the world of automated insurance billing processes.

With automation taking the world by storm, processing insurance bills can be done in a matter of minutes with an effective automated billing system.

Curious to know how automated billing processes work? This blog will cover the challenges associated with traditional billing processes and the benefits that automated billing system offers.

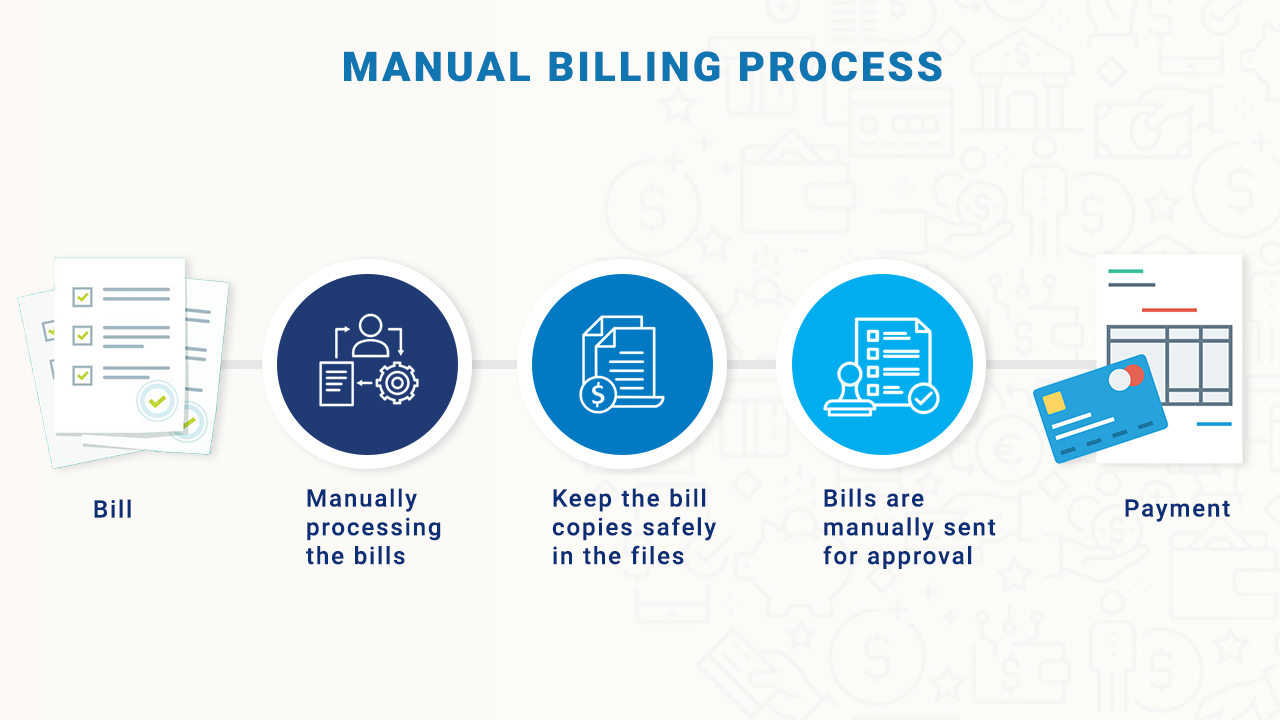

Manual Billing Processes

First, let us see how the manual billing process works.

Here are a few challenges associated with manual billing processes:

Human Errors

When calculations are involved, deleting or adding a single digit can create a massive difference. Manual data input may lead to inaccuracies in dates, wrongly billed items, incorrect account numbers, and wrong purchase order numbers. Such tedious and labor-intensive processes may also result in duplicate entries and double payments, which are a huge loss for the carriers.

Payment Delays

Many times bills get stuck and forgotten in the lengthy approval process, especially when several people are involved in the approval. AP professionals make constant follow-ups which are time-consuming, resulting in delays. Moreover, delays can cause burdens of penalties and, in some cases, bills may get misplaced in the paper works, leading to even more grave situations.

Risk of Fraud

In the world of increasing cyber crimes, bills and financial information should not be shared via emails and legacy applications, especially when third parties are involved. These should be exchanged in a safe and secure environment that protects against data theft and manipulation of records.

Storage

Many a time, in case of disputes, your vendor may want the payment copies since the start of the deal; say, which was around 12 years back. The long process of pulling out information from cabinets or internal computer storage may take a toll on your teams. Also, tracking down acknowledgment emails can be quite challenging.

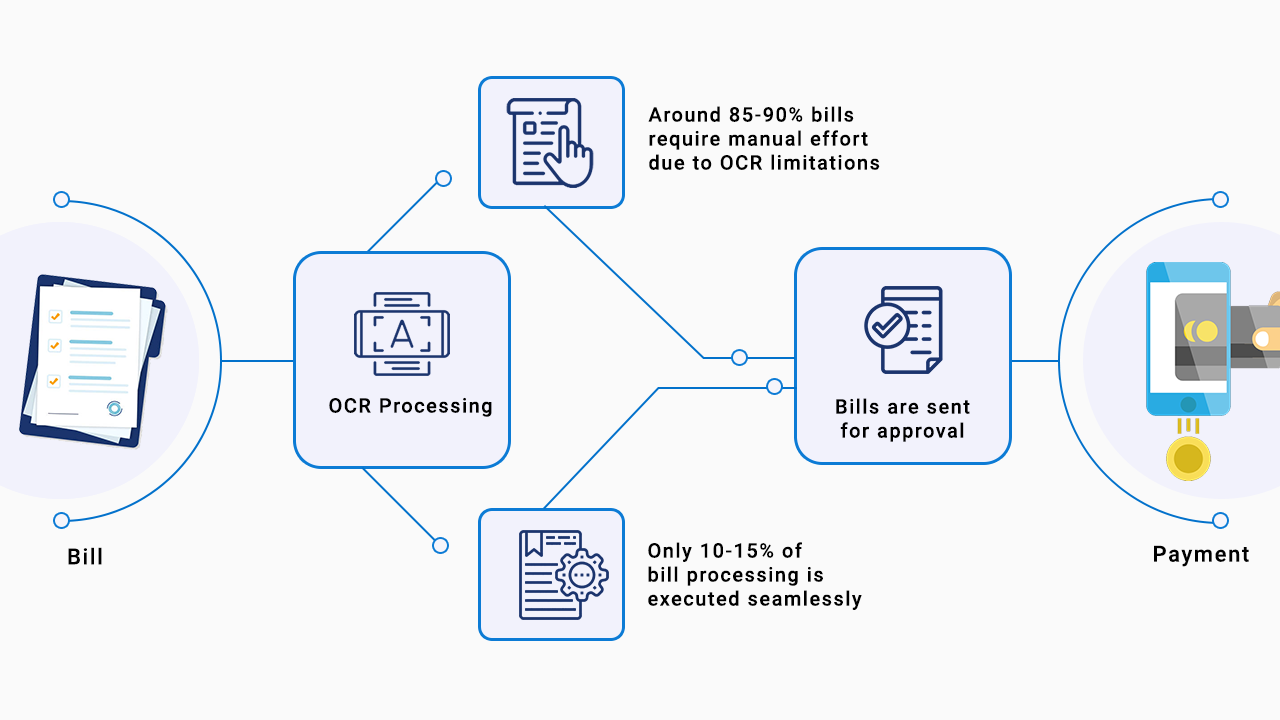

Conventional OCR-Based Challenge

In addition to the above-mentioned manual challenges, there are also some loopholes in traditional OCR-based bill processing. This is how conventional OCR-based bill processing works:

Also, a common limitation of the OCR-based billing system is its high dependency on input quality. It is incapable of working with real-world variability found in bills and other document types. Besides, OCR can also cause inaccuracies, which can significantly create a crucial impact on accounting. One out of every ten characters will be extracted incorrectly. For insurers extracting hundreds or thousands of bills a month, this adds up to a large amount of loss. Henceforth, insurers must seek automated methods for accurate and efficient billing processes.

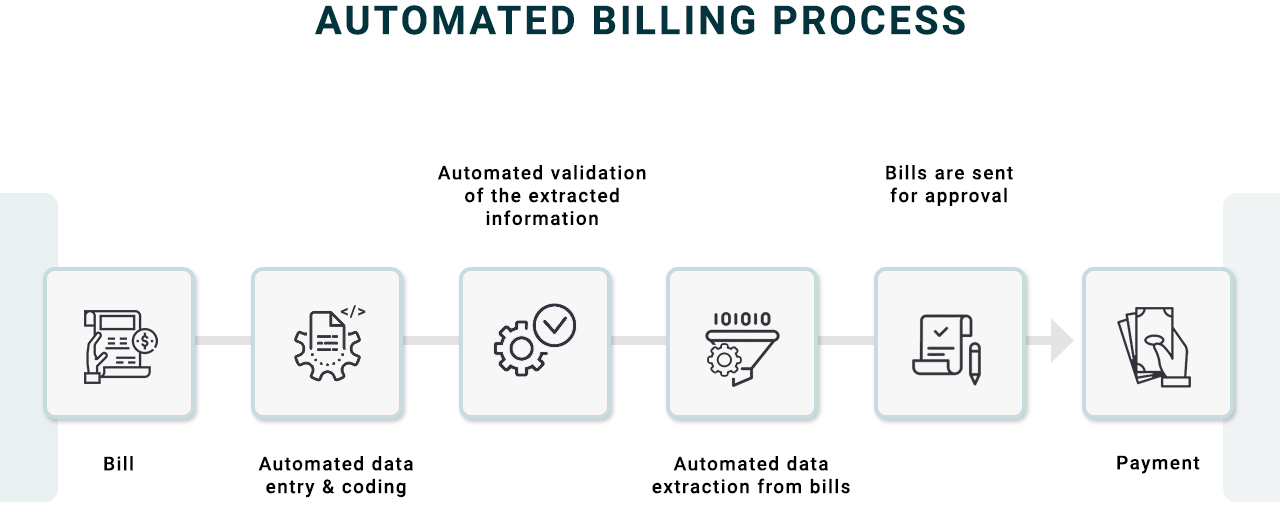

How does Automation Help in Seamless Insurance Billing Processes?

Automated bill processing system helps businesses to eliminate inefficient manual processes, reduce processing errors, and enables employees to focus on other significant value-adding tasks. Insurance organizations are leveraging billing process automation to boost cost efficiency, improve user experiences, enhance productivity, and ensure financial continuity in businesses.

Let’s quickly take a look at a few benefits of automated bill processing.

Enhances Accuracy & Drives Efficiency

An automated billing system helps insurers achieve a streamlined workflow, thereby reducing time, decreasing errors, and increasing accuracy.

In addition, it eliminates error-prone & slow manual processes and, extracts data directly from bills, and feeds information directly into the accounts payable system in real-time, making this entire paperless process even more efficient.

Improves Monitoring & Quick Access to Financial Data

For AP teams, automating the billing system grants authorized users quick access to crucial data. This enables the users to track consumption and cost metrics, acquire visibility into spending and working capital, manage utility expenses, reveal new opportunities, etc.

Moreover, with the increased transparency that automation brings, your organization can easily monitor expenditures and understand where and when the money is spent, helping companies make appropriate business decisions.

Increases Cost Savings

Thinking of the time, you will save in processing each bill? And how about the fewer resources you will require for the job? Adding up to that, you no longer need to pay late fees or penalties. The integrated effect of implementing automation in your billing system generates rapid ROI and also amounts to considerable savings in the long run.

Increased Fraud Prevention

Automation helps in the easy detection of forged, duplicated, and manipulated bills as they are being processed. This proactive approach towards fraud protection can save your organization from losing time and money.

Better Cash Flow

Automatic bill processing gives finance teams better control over cash flow and budgets as the process improves end-to-end visibility, enabling expense commitments to be managed more accurately.

Wrapping Up

From this blog, it is clear that automating insurance bill processing can benefit businesses large and small. Henceforth, through an automated bill processing solution, you can achieve:

- A scalable solution that can adapt to any format, layout, or template.

- A solution that enables your AP team to concentrate on significant tasks, thus helping you grow your business.

- A solution that provides high accuracy.

- A solution that seamlessly integrates into your system.

Contact us today to outsource your processes to us and get started with automation.

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence