Customer satisfaction and retention are significant KPIs for any business, and contact centers play a vital role in determining this success. Contact center representatives are under continuous pressure to provide rapid, personalized, and quality services while maintaining relatively low handling time goals and strong first-call resolution.

The Coronavirus wave had a crucial impact on call centers in the recent past. Call volumes have skyrocketed and the average handle time, hold times, abandonment rates & average queues in contact centers increased significantly. Henceforth, the majority of insurers noticed unprecedented growth in client demands.

Then what were insurers supposed to do to retain happy customers? Recruit more contact center employees? That would increase the overhead costs. Then how could they meet the evolving demands and enhance customer satisfaction?

Automation can come as a solution to this problem. In order to meet the drastic shifts in customer demands, most insurance companies chose automation. Adopting automation in contact centers is a way to avoid the repetitive operations that plague contact centers, thereby improving productivity, client satisfaction, and revenue.

In this blog, we will discuss some contact center challenges and how automation can resolve them and help contact centers improve efficiency.

Challenges Faced by Contact Centers

Poor Client Satisfaction

One of the most important aspects of measuring performance levels is the first call resolution rate (FCR), which is crucial in achieving high customer satisfaction rates. As insurance businesses are undergoing a digital shift, companies are seeing an increase in complex customer inquiries. Generally, these issues require longer resolution times. But if customers need to talk to multiple contact center professionals in order to get their questions answered, client satisfaction takes a hit and reduces, leading to increased customer attrition.

High Employee Attrition

Considering the long hours and demanding targets, the work environment in contact centers is quite stressful. This is the reason the contact center industry has a high turnover rate.

When a professional resigns from a contact center, it’s strenuous for other team members to take up the additional workload. Besides, hiring new resources and training them becomes more and more difficult. This results in reduced team morale, mounting expenses, and dissatisfied customers.

Lack of Budget

One of the vital challenges for contact centers is a lack of monetary resources. A high staff turnover rate and, therefore, increased staffing costs lead to consistent financial loss. As per the leadership team's opinion, this leads to a heavy drain on contact center revenue. Due to this, some insurers cut their losses, resorting to other unsuccessful methods of addressing their client needs.

Long Wait Times

Due to a lack of resources, customers often experience long wait times. You may think it is not a big deal when your contact center staff makes customers wait a few more seconds, but your clients probably disagree. Timely Resolution of a problem is an integral and significant part of customer experience.

This is a vital lesson for businesses in any sector, including the insurance industry. If your employees are making clients wait, you may have a big problem.

Decreased Productivity

Oftentimes there are technical IT glitches with contact centers. On a busy day, phone lines might be non-functional or jammed. This leads to wasted time, customer irritation, and a significant decrease in business productivity overall.

How Automation Enables Contact Centers to Enhance Efficiency?

Contact centers always have to deal with a vast amount of mundane and repetitive tasks that are important but hardly require any decision-making. Because contact centers have such a large number of rule-based processes, automation will significantly impact the overall experience for both contact center employees and their clients. Henceforth, insurance companies should opt for RPA-driven outsourced contact centers that will enable them to enhance business efficiency.

Let’s discuss a few ways in which automated contact centers can help your insurance business keep up with the client's expectations.

Optimized Overhead Costs

With the help of RPA, the cost issues related to new recruitment can be solved in the best way, and without any trouble.

In fact, when your contact center leverages RPA, it reduces the operational costs of an organization by approximately 70%. Now that is a considerable percentage. Also, the automation technology is entirely adaptable and therefore doesn’t require changes in the long run, thus decreasing other major expenses as well. So, it is definitely a credible solution to choose.

Enhanced Customer Experience

For businesses to thrive and grow, customer experience has always been an essential component in the process. RPA plays a very crucial role in improving customer experience. For instance, the utilization of automation tools for managing repetitive everyday activities in contact centers, like recording updates, checking the status of an order, etc., can be beneficial.

But how will it enhance customer experience? Well, such tasks, when automated, will empower the contact centers to deliver exceptional and fast customer service. Moreover, in today's fast-paced world, if your customer service is not available round-the-clock, it can adversely impact your business. Agents may or may only be available sometimes, but automating contact center processes can help you serve your customers anytime they want. This will, in turn, result in a good customer experience and increased retention rates.

Provides Valuable Insights

Robotic process automation can help contact center professionals to soar high when it comes to sales. RPA can collect tons of information from various systems, process them at high speed, and present you with deep and useful insights to know about your prospects better.

Moreover, this is done in real-time, thus enabling the professionals to design tailored campaigns and make better decisions that will accelerate sales.

Anticipatory Actions

Automated solutions help to predict what customers want even before customers ask about what concerns they might have. AI-powered RPA bots can analyze infinite websites, in-app activities, and history in real-time to help contact center agents know the potential pain points of the clients and other relevant information.

These preemptive actions help resolve customer queries rapidly without any delays and significantly boost customer satisfaction and retention.

Reduced Workload

Automation in contact centers can ease the job of employees, helping them become more productive and improving their satisfaction level. The happier the staff will be, the lower the attrition rate will be.

Using RPA, contact center staff can manage tedious and repetitive operations with ease and accuracy. And not to forget ‘Bots neither tire nor retire.' You just need to attend them once, and they will work for you seamlessly while saving huge costs.

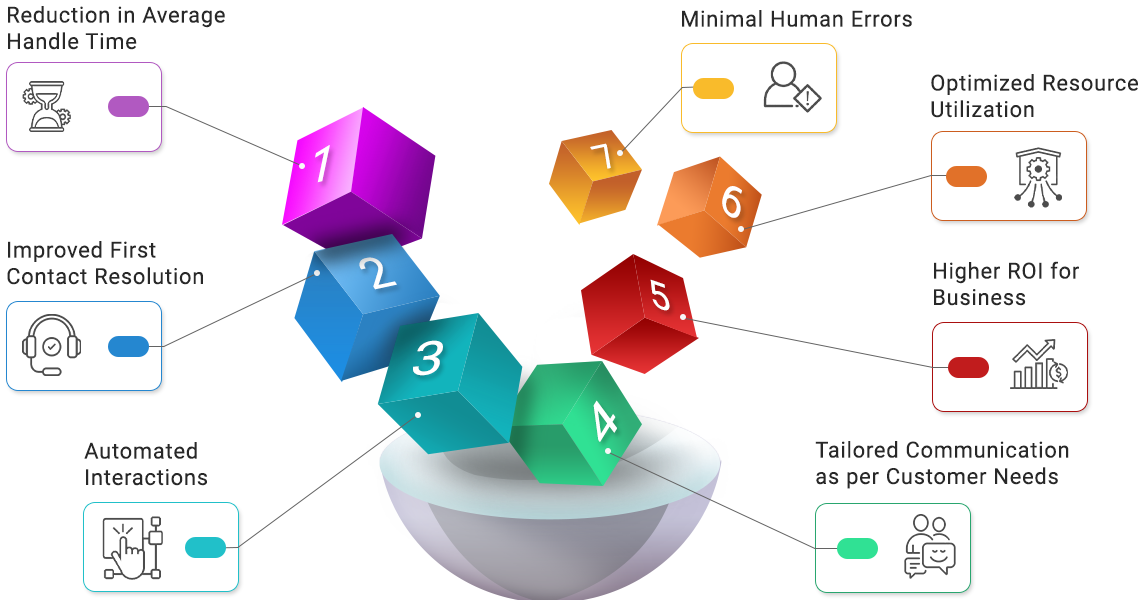

Here are some other significant benefits of implementing RPA in contact centers:

Wrapping Up

Insurance contact centers should definitely embrace RPA in their processes to leverage the myriad benefits that it can bring. Want to automate repetitive manual activities? Save cost, time, and effort while improving efficiency!

Partner with us, and we will do the rest.

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence