Brief Summary: The evolution of insurance claims processing from manual paperwork to today's technology-driven landscape is undeniable. This blog explores the benefits of outsourcing claims intake, detailing tasks that can be delegated. It emphasizes the importance of outsourcing in the insurance industry, highlighting it as a strategic move toward achieving the set goals.

In the early days of insurance, processing claims meant drowning in a sea of paperwork, where each policyholder's information was meticulously recorded with pen and paper. Fast forward to today, the present landscape has transformed dramatically.

Insurance firms now navigate a complex terrain of software tools, specialized skills, and efficient systems to handle claims efficiently. But even with these advancements, insurers find themselves grappling with an ever-increasing workload, often at the expense of their core functions like policy creation and sales.

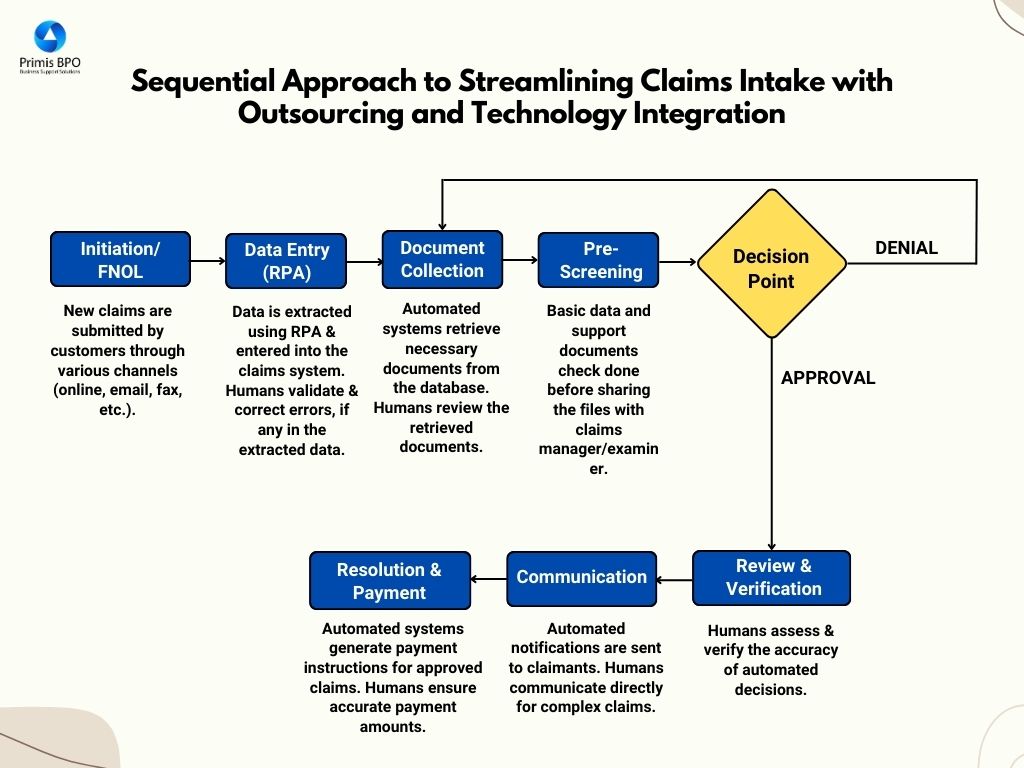

Enter outsourcing insurance claims intake – a strategic move that is streamlining the process for insurance carriers worldwide. But there’s a question –

What claims-handling tasks can be outsourced?

- Claims intake/FNOL

- Reviewing claim submissions

- Data entry and verification

- Corresponding with beneficiaries and insurance agents

- Preparing forms for claims

- Maintaining and managing records of insurance policies and claims in database systems

- Determining claim amounts and policy coverage

- Claims status tracking

Specific tasks within Claims Outsourcing encompass:

Claims Outsourcing proves particularly suitable for repetitive, compliance- focused insurance claims processing tasks that demand meticulous attention to detail.

But what exactly is outsourced insurance claims handling, and why should your business consider it?

In this blog, we will delve into the intricacies of the insurance market, explore the nuances of outsourced claims management, and discuss why it's vital for insurance companies of all sizes.

The right BPO partner can be a catalyst for growth, innovation, and competitive advantage. While cost reduction is always the key objective, BPO partnerships create opportunities to prioritize customer experiences and operational agility alongside efficiency targets.

Maximizing Business Efficiency: 5 Key Benefits of Outsourcing Insurance Claims Processing

Economize on Software Procurement and Maintenance

Eliminate the need for purchasing, updating, or maintaining costly software. In the past, insurance firms bore the burden of these expenses. However, the current landscape offers a simpler alternative. Outsourcing providers offer comprehensive solutions without the hassle of software management.

Simplify Complex Systems

Streamline operations by centralizing various facets of claim processing. In- house systems often lead to delays arising from multiple factors and teams. Outsourced units, however, handle the entire claim processing, ensuring quicker turnaround times. This consolidation enhances efficiency and expedites results.

Tailored Service Packages

Exhibit exceptional foresight by offering tailored service packages. They assign dedicated teams to manage each insurance claim project, leveraging skilled professionals working around the clock. In contrast, insurance companies struggle to retain top talent. Outsourcing alleviates this burden and introduces a level of convenience and efficiency, making it a strategic decision.

Higher Quality Standards with Reduced Costs

Reduce expenses while maintaining or even surpassing quality standards, transforming claim processing. Moreover, customized services exemplify this shift, resulting in improved accuracy and cost-efficiency for insurance firms. This dispels the notion that quality service necessitates compromise, marking a paradigm shift in the outsourcing landscape.

Numbers Speak Volumes!

Forbes highlighted that about two-thirds of businesses cite cost savings as a primary advantage of outsourcing. Moreover, the same report also underscores that 37% of SMBs have already outsourced at least one business function.

These figures represent a crucial pain point for insurers, driving the need for a solution that's efficient, cost-effective, and customer-centric.

By entrusting this critical process to specialized BPO firms, insurers can enhance workflows, reduce operational costs, and ultimately enhance customer satisfaction.

What’s Next?

As we wrap up, it's clear that the future holds immense promise for insurers willing to embrace innovation and efficiency. With the landscape of the insurance industry rapidly evolving, staying ahead means not only adapting but also leveraging strategic solutions like outsourcing.

With cost savings, smoother workflows, and happier customers all within reach, outsourcing is a chance to make real, positive changes. As technology and markets keep evolving, staying on top means being ready to adapt and explore new options.

So, what comes next?

It's about seizing the opportunities that outsourcing offers and using them to make your insurance business even better.

Take the plunge, set your goals, and get in touch with Primis BPO for a reliable outsourcing partner.

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence