Executive summary

The future of BPO is evolving with AI and automation, particularly in sectors like insurance, where tasks are streamlined for efficiency and accuracy. While AI offers several benefits, like data analysis, human interaction remains crucial in customer service. A hybrid approach blending AI with human oversight is emerging to maintain quality service standards.

As we stand on the brink of technological evolution, the future of business process outsourcing (BPO) is a topic that ignites both curiosity and concern among industry enthusiasts. With advancements in artificial intelligence and automation reshaping traditional business processes, the landscape of BPO services is undergoing a profound transformation. As businesses adapt to these changes, there is a critical need to explore how emerging technologies will redefine the role of BPO in delivering efficient and cost-effective solutions.

This blog will explore the relationship between automation, AI, and the human touch in BPO. From exploring the latest technologies to examining real-world benefits, we will uncover how businesses can harness the capabilities of technology while preserving the essence of human connection.

The Role of Technology in BPO

In the realm of Business Process Outsourcing (BPO), the insurance sector stands at the forefront of technological integration, leveraging automation and artificial intelligence (AI) to streamline operations and elevate efficiency.

Automation has transformed repetitive tasks within insurance BPO processes, significantly reducing manual intervention and thereby minimizing errors. Routine activities such as data entry, claims processing, and underwriting analysis are now swiftly executed with precision, thanks to advanced robotic process automation (RPA) systems. This not only accelerates turnaround times but also ensures a higher level of accuracy, mitigating the risks associated with human error.

Furthermore, AI algorithms are increasingly being deployed in BPO services to:

- Analyze vast amounts of data in the insurance sector, enabling outsourcing providers to extract valuable insights and enhance decision-making processes.

- Assess risk factors more comprehensively using machine learning models, allowing insurers to better tailor their offerings and pricing strategies.

- Facilitate the interpretation of customer inquiries by leveraging NLP technologies, leading to faster resolution times and improved customer satisfaction.

- Enable proactive risk management with AI-powered predictive analytics, helping insurers anticipate and mitigate potential claims, thereby reducing losses.

As per the IBM Global AI Adoption Index report, 35% of companies are using AI in their businesses, and an additional 42% reported they are exploring AI for future integration. Such numbers imply that with the integration of automation and AI, insurance BPO processes are becoming more efficient and adept at meeting the evolving needs of the industry and its clientele.

The Continued Importance of Human Oversight

However, amidst this technological revolution, one vital question looms large:

What about the human touch?

While automation and AI excel at streamlining processes, they lack the warmth and empathy that only humans can provide. For instance, complex claims or nuanced customer inquiries often require human intervention to ensure satisfactory resolution.

Whether it's resolving customer queries, negotiating deals, or providing personalized assistance, the human touch possesses the ability to empathize with customers, understand their unique circumstances, and offer personalized solutions, which contributes significantly to customer satisfaction and loyalty that technology alone cannot replicate.

What do the stats say?

A study by PwC found that 82% of U.S. and 74% of non-U.S. consumers want more human interaction in the future. This paradox underscores the delicate balance that BPO firms must strike when leveraging technology without sacrificing human connection.

Moreover, human oversight serves as a critical safeguard against potential errors or biases that automated systems may overlook. In the insurance sector, where accuracy and compliance are non-negotiable, human oversight ensures that decisions are made ethically and in alignment with regulatory standards.

Additionally, human agents possess the adaptability to handle unforeseen situations or exceptions that may arise, providing a level of flexibility that automated systems alone cannot match.

The Future of BPO with a Blend of Technology

Employing a hybrid approach in BPO involves leveraging both human expertise and AI-powered automation to achieve enhanced efficiency while upholding the high standards of service and integrity expected in the industry. This enables businesses to cultivate an adaptable workforce capable of navigating the dynamic BPO landscape by strategically assigning tasks, integrating AI technologies, and harnessing the unique capabilities of human employees.

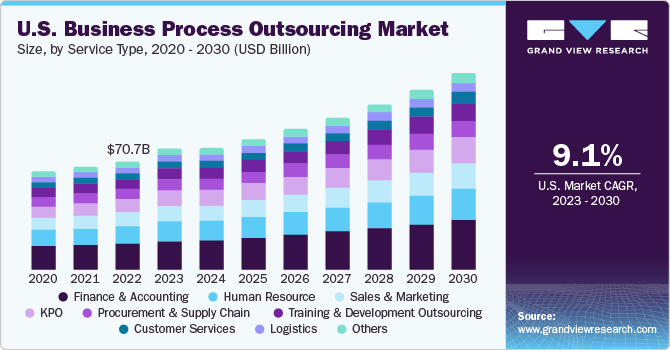

A recent report highlights that 'the global business process outsourcing market is projected to grow at a CAGR of 9.1% from 2023 to 2030.' Technological integration and human intervention emerge as two significant drivers fueling this growth trajectory.

Having said that, to effectively execute a collaborative strategy, BPO firms should prioritize the following:

By doing so, it becomes feasible to achieve an optimal equilibrium between human proficiency and AI-driven automation, paving the way for a more sustainable and competitive BPO industry.

Outsource your insurance business operations to Primis BPO. We leverage a combination of human intervention and automation to streamline your processes.

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence