Key Takeaways:

- Automation reduces processing time and workforce requirements.

- Real-time processing improves data velocity, completing tasks in months instead of years.

- Standardized data extraction improves decision-making and modernizes workflows.

About the Client

The client, a prominent insurance broker headquartered in New York, caters exclusively to nonprofit and human service organizations. The company specializes in creating tailored insurance programs by leveraging its strong relationships with insurance carriers.

Challenges in Focus

Processing over 100,000 loss-run documents shared by carriers in 500+ varying formats was a Herculean task. The manual workflow required significant human effort, with 30 full-time employees (FTEs) dedicated to deciphering the documents. This led to:

- Time-Intensive Operations: Prolonged processing cycles delayed insights and decision-making.

- High Error Rates: Human errors resulted in data inconsistencies and rework.

- Escalating Costs: Increased workforce expenses strained the budget.

Business Objectives

The client sought to address these challenges by embarking on a comprehensive digital transformation journey, with key objectives including:

- Automate the data extraction process to eliminate bottlenecks.

- Reduce reliance on the manual workforce for simple loss runs to drive financial savings.

- Standardize and improve data quality for downstream processes.

The Primis Approach

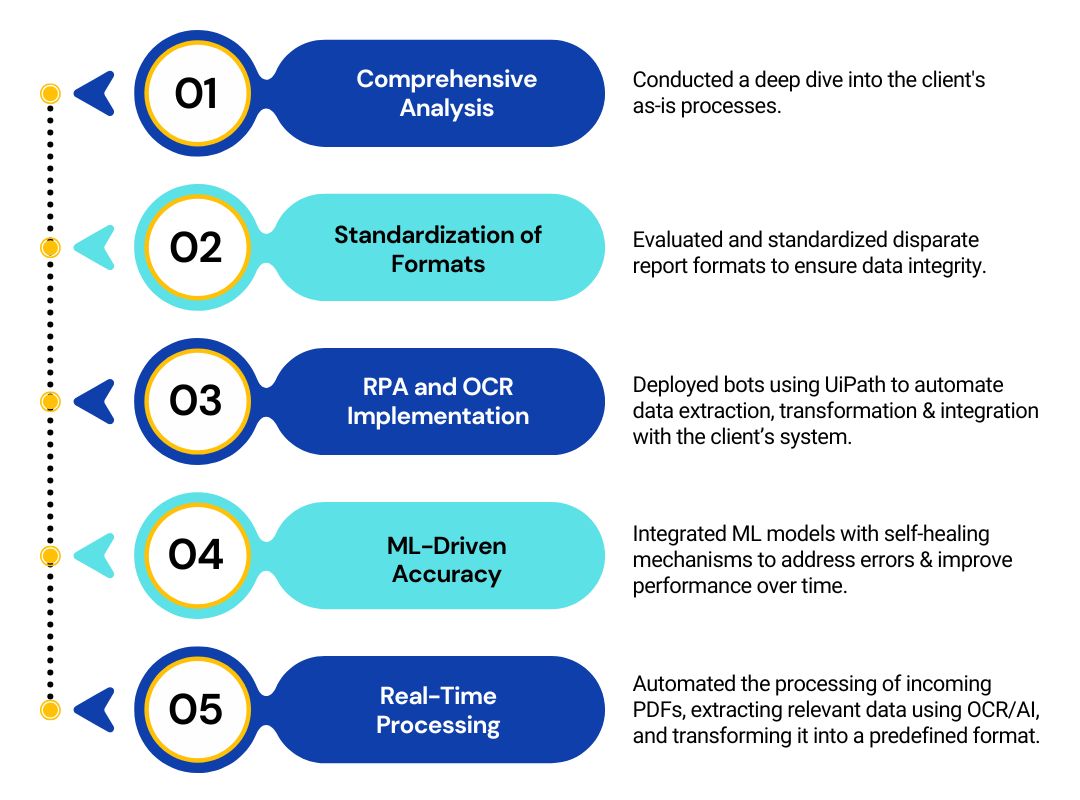

Primis adopted a systematic and client-centric approach, leveraging its P&C Insurance Center of Excellence (CoE) to deliver an optimal solution:

Outcomes Delivered

- 100,000+ Pages Processed: Delivered defect-free results.

- 70% Faster Processing: Accelerated workflows with automated, real-time processing.

- Standardized Data: Consolidated data from diverse formats into a unified structure, enabling streamlined analytics.

- Decrease in Time: Significant reduction in processing time.

- Significant Cost Savings: Workforce allocation dropped from 30 FTEs to 7, resulting in a 75% cost reduction.

Why Partner with Primis for Outsourcing?

Primis transforms outsourcing with advanced automation capabilities. Our solutions streamline processes across industries, automating repetitive tasks to reduce costs, enhance accuracy, and boost efficiency.

Primis BPO’s automation capabilities encompass front- and back-office self-driven bots, ensuring seamless operations across every facet of your business. Built on a secure platform architecture, our front-office bots:

- Operate efficiently on physical and virtual systems.

- Deliver exceptional cost-effectiveness without compromising performance.

- Offer enterprise-grade compliance, ensuring robust governance and data security.

Furthermore, our unattended bots are designed for high-volume, back-office tasks. These bots operate in batch mode, processing tasks like data entry, document handling, etc., with unmatched speed and precision. Key features include:

- Queue and workload management to ensure smooth task distribution.

- Enterprise-level scalability to handle increased demands effortlessly.

To Conclude

The automation of loss-run data extraction is a game changer for insurance firms seeking to optimize operations and reduce costs. The case study showcases our collaboration with a $20M P&C insurance client and highlights how a well- planned automation workflow and human oversight for complex cases can deliver measurable outcomes.

Ready to automate your processes? Partner with Primis to unlock the full potential of outsourcing and automation to drive your insurance operations forward.

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence