Executive Summary:

In-house accounting poses several challenges. Whereas, outsourcing

provides access to expert assistance and the latest tools, easing year-end reporting burdens.

This blog highlights the benefits of outsourcing account reporting and explores how

embracing outsourcing can transform the financial landscape for businesses.

What’s the challenge?

Throughout peak seasons, managing accounting internally presents numerous hurdles, such as:

- Balancing accuracy and speed while handling a surge in data influx.

- Lack of specialized expertise leads to errors in financial reporting and compliance issues.

- Optimizing software usage to streamline reporting processes efficiently.

- Managing workload distribution effectively to mitigate burnout risks among staff.

Henceforth, the notion of simplifying account operations might sound like a distant dream.

But what if I told you there's a way to alleviate the burdens, streamline processes, and regain calmness amidst the year-end turmoil?

How can this be resolved?

Here, outsourcing accounting processes comes in—a strategic approach that is converging technology and expert assistance to transform accounting operations.

According to a recent survey by Deloitte, 52% of executives outsource their business functions, including accounts.

Why?

Outsourcing offers a streamlined approach to overwhelmed businesses, providing access to specialized expertise and the latest tools without the hefty investment. In the case of accounts, this eases the burden of year-end reporting.

Scenario: Your insurtech firm is expanding rapidly; of course, that's a happy moment, but your internal accounting team is struggling to keep pace with the influx of transactions.

By outsourcing your accounting tasks to a reliable service provider, you not only free up valuable time and resources but also ensure that your financial data is handled with the utmost precision and efficiency.

4 Key Areas Bolstered by Outsourced Accounting Services

1 - Reliable bookkeeping services:

Maintain accurate financial records without the need for extensive in-house resources. Outsourced teams manage bday-to-day bookkeeping tasks, reconcile accounts, manage accounts payable and receivables, and provide timely financial reports, allowing firms to focus on value-added advisory services for their clients.

2 - Efficient financial statement preparation:

Streamline the process of financial statement preparation by organizing and presenting financial data appropriately, enabling businesses to gain valuable insights into their financial health and make informed decisions. Leveraging automation tools and software can significantly decrease the effort and time required to generate financial statements, allowing finance teams to focus on higher-value tasks such as analysis and strategic planning.

3 - Comprehensive audit support:

Leverage comprehensive audit support, including data collection and reporting. Additionally, third-party providers also assist in bpreparing audit schedules, conducting substantive testing, and facilitating communication with auditors, ensuring a smooth audit process for clients.

4 - Streamlined payroll processing:

Alleviate the burden on businesses by handling tasks such as calculating wages and processing payments. This ensures timely and accurate payroll processing while minimizing compliance risks and administrative overhead.

Are the facts supporting this?

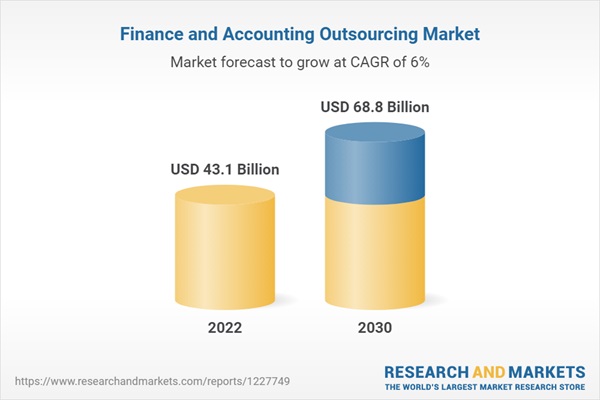

As per a recent report by Research and Markets, the global market for finance and accounting outsourcing is projected to reach a size of US$68.8 billion by 2030, growing at a CAGR of 6% over the forecasted period.

Wrapping Up

Choosing the right outsourcing partner is paramount for firms looking to simplify accounting operations. While the benefits of outsourcing are vast, they can be fully realized with a reliable firm like Primis.

As a trusted accounting outsourcing provider, we offer tailored solutions that streamline processes, clear backlogs, and enhance overall efficiency for businesses worldwide. With our support, clients experience increased capacity, productivity, and, ultimately, greater value for their businesses.

If you're seeking to optimize your accounting operations, reach out to Primis and learn more about how we can empower your firm for success.

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence