Key Takeaways:

- Insurance renewals can be resource-intensive and time-consuming.

- In-house teams may struggle with the high volume of renewals, leading to delays and inefficiencies.

- Outsourcing can streamline the process, ensuring timely and accurate renewals while engaging internal resources in other business tasks.

Insurance renewals are often seen as one of the most demanding tasks in the industry, draining time and resources from your core operations. The challenge? Hundreds, sometimes thousands, of policies come up simultaneously for renewal. The renewal process is not just about sending out a new premium; it requires meticulous attention to detail, from pulling loss run reports to evaluating policy adjustments. In an industry as competitive as insurance, this pileup of tasks for an in-house team can stretch resources thin, leading to delays that may result in dissatisfied customers—and, ultimately, lost business.

So, how do you handle this influx without overburdening your team? The answer is Outsourcing.

Let’s explore this blog and discover the in-house challenges with insurance operations and how outsourcing can optimize insurance renewal processes.

Outsourcing: A Tailored Solution for Operational Excellence

Outsourcing offers a solution in terms of operational efficiency. By delegating the time- consuming back-end tasks—like taking in renewal requests and coordinating follow-ups with policyholders—to a specialized team, in-house underwriters receive the critical data they need on time. This ensures renewals are processed efficiently, policies are updated accurately, and clients remain satisfied. With outsourcing, you can optimize your renewal workflow, letting your in-house team concentrate on growing your business.

In fact, recent statistics show that 70% of businesses indicated cost reduction as the primary reason for outsourcing—a crucial advantage in a competitive market. The result? A seamless, stress-free renewal process that keeps your clients satisfied and your business growing.

5 Reasons to Leverage Outsourcing for Streamlined Insurance Policy Renewals

Optimized Resource Allocation through Specialized Insurance Renewal Teams:

Deploy specialized teams dedicated solely to insurance policy renewals, ensuring that routine administrative tasks—such as data collection, document verification, and policy issuance—are handled efficiently. This allows insurers to leverage their internal talent for high-impact activities and customer relationship management, driving better outcomes during peak renewal periods.

Seamless Integration and Workload Onboarding for Enhanced Operational Fluidity:

Integrate third-party provider’s systems seamlessly with existing insurer workflows, allowing to absorb renewal tasks effectively. This ability to remotely connect to insurers’ systems and adapt to established processes ensures a smooth onboarding experience, enabling organizations to maintain productivity and operational continuity.

Robust Quality Assurance Protocols and Performance Monitoring for Sustained Service Excellence:

Implement comprehensive quality assurance measures and performance metrics to ensure adherence to industry standards during the renewal process. By maintaining rigorous oversight of service delivery, insurers can ensure high-quality outcomes, driving customer satisfaction and fostering long-term client retention even during the busiest renewal periods.

Scalable Solutions for Fluctuating Renewal Volumes:

Offer scalable solutions for handling fluctuating renewal volumes during peak seasons. By providing flexible staffing options, outsourcing firms can quickly adjust the number of specialists working on renewals to match demand, ensuring that no policies are overlooked and that client service levels remain high.

Rapid Turnaround of Complex Renewal Requests with Industry Expertise:

Provide access to industry experts who can expedite the intricate and complex renewals requiring specialized knowledge, such as in cases involving claims history evaluations, multi-line coverage adjustments, etc., ensuring accuracy and compliance while alleviating the workload on internal teams.

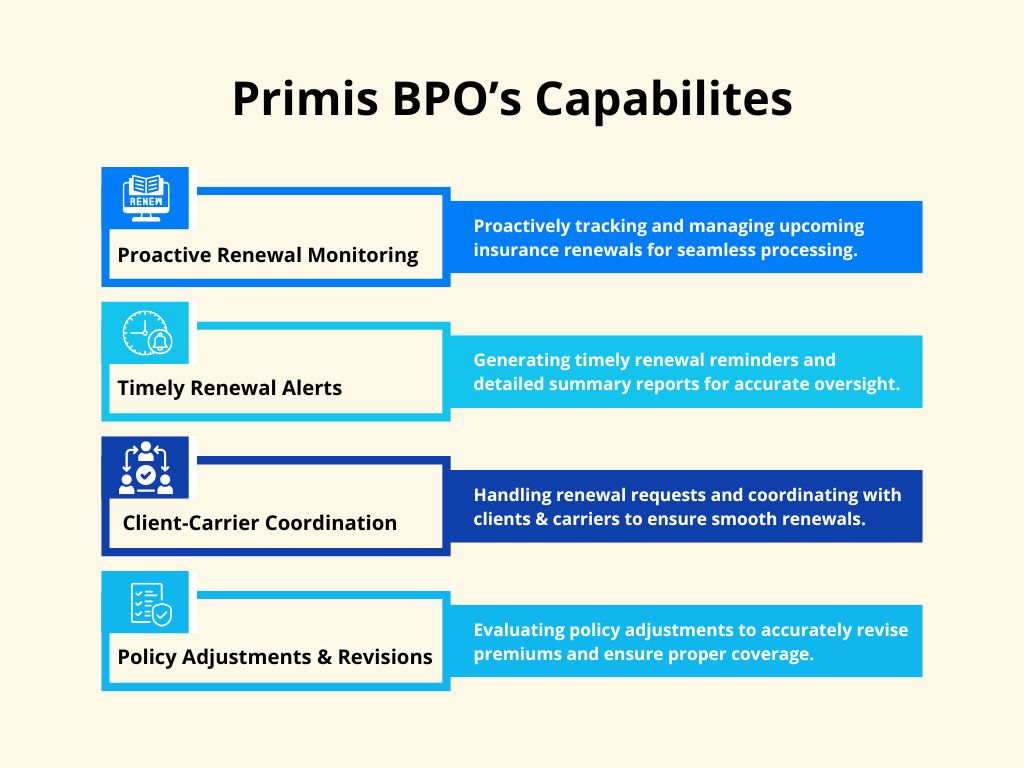

Primis' Comprehensive Insurance Renewal Processing Solutions

Final Thoughts

In the present insurance landscape, the key to staying ahead isn’t just about meeting deadlines—it’s about transforming routine processes into opportunities for growth. Imagine a world where your internal teams are free to innovate while the complex, data-heavy tasks of renewals run like clockwork in the background. That’s the power of outsourcing. It’s not just a cost-effective solution but a way to future-proof your operations, boost client retention, and ensure your business is always one step ahead.

Ready to make your renewals more than just routine? Connect with Primis BPO to outsource smartly and turn this critical process into a competitive advantage.

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence