Claims processing is a critical function in the P&C insurance industry. Carriers face constant challenges in meeting policyholder expectations while simultaneously managing operational costs. Traditionally, claims processing has been a human-intensive process that is prone to errors and delays. Therefore, it is essential for carriers to optimize their claims processing workflows to keep up with client demands, reduce costs, improve efficiency, and enhance the customer experience.

The Present Approach

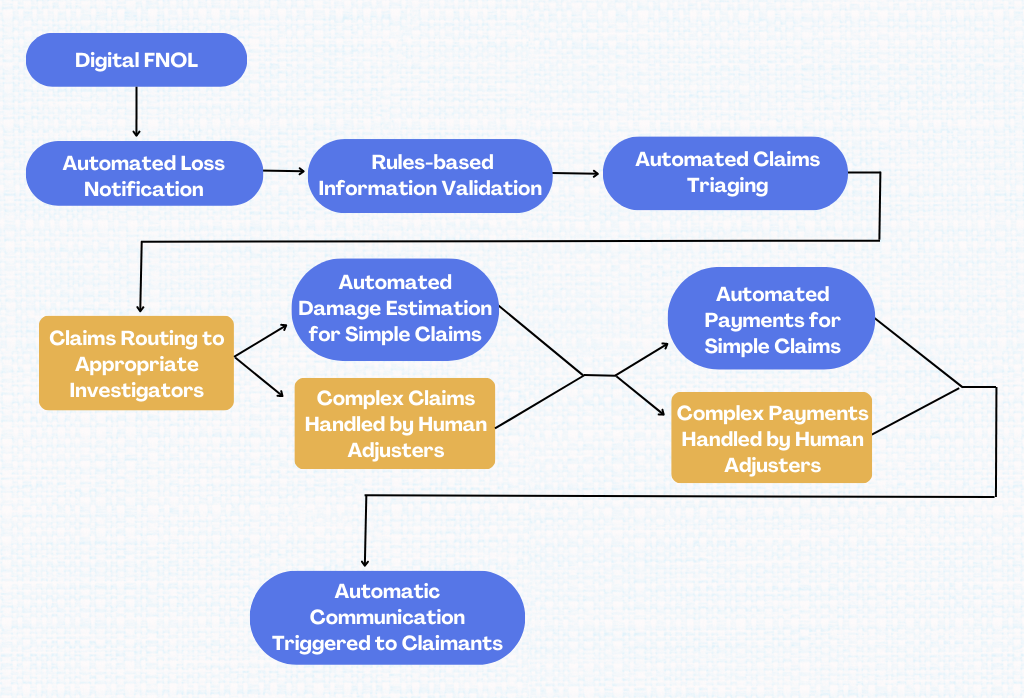

Insurers are now leveraging Robotic Process Automation (RPA) to reduce manual activities. RPA can automate repetitive tasks such as FNOL intake, verifying coverage, prioritizing claims with claims triage, sending notifications to the policyholder, and making payments. While there have been some incremental benefits, the core process still has some bottlenecks.

To address these challenges, insurers are now looking to integrate RPA with Business Process Outsourcing (BPO) to create a more efficient and effective claims processing workflow. BPO providers can bring their expertise to claims processing, while RPA can automate mundane tasks.

That being said, this blog highlights how the convergence of RPA and BPO will revolutionize claims processing in the P&C insurance industry, streamlining workflows, reducing errors, and improving customer satisfaction.

The Synergy of RPA and BPO: Transforming Claims Processing Efficiency

According to Deloitte, “78% of businesses that have already implemented RPA expect to significantly increase investment in RPA.” This trend highlights the growing recognition of RPA's potential to expedite routine tasks and enhance overall efficiency.

Moreover, another recent report revealed, “The global business process outsourcing market size was valued at USD 261.9 billion in 2022 and is projected to expand at a CAGR of 9.4% from 2023 to 2030.”

Furthermore, this report highlights, these BPO services find prominent demand due to their benefits, such as increased flexibility, reduced costs, and enhanced service quality. Therefore, outsourcing non-core activities to specialized service providers allows insurers to focus on their core competencies while benefiting from expertise, scalability, and cost optimization.

Combining the strengths of RPA and BPO brings forth a synergistic partnership that optimizes claims processing. RPA facilitates the automation of repetitive, rule-based tasks, such as data entry, validation, and documentation, reducing the potential for human error and increasing operational speed.

Meanwhile, BPO augments this automation with expert resources, domain knowledge, and scalability, ensuring seamless and efficient execution of critical processes.

Here are a few ways in which the integration of Robotic Process Automation in BPO can enhance efficiency and productivity:

Process Acceleration

By integrating Robotic Process Automation into BPO operations, insurers can significantly accelerate claims processing. Attended or unattended bots can automate time-consuming manual tasks such as data extraction, validation, and entry, resulting in faster claim settlement. This streamlined approach not only improves operational efficiency but also reduces the time taken to deliver compensation to policyholders, enhancing customer satisfaction and retention.

Accuracy and Compliance Enhancement

Claim processing requires meticulous attention to detail and adherence to regulatory guidelines. RPA bots ensure accuracy and compliance by executing tasks with consistent precision. They can cross-validate data, flag inconsistencies, and verify policy information against predefined rules. By reducing human errors, RPA in BPO minimizes the risk of compliance violations, costly rework, and customer dissatisfaction.

Seamless Data Integration

One of the primary benefits of integrating RPA and BPO is the seamless integration of data across systems. The bots can extract relevant information from various sources, including legacy systems and external databases, and consolidate it into a centralized repository. This comprehensive data integration facilitates holistic claims analysis, enables better and more informed decision-making, and enhances the overall efficiency of the claims processing lifecycle.

Intelligent Claim Routing and Triage

With the incorporation of RPA, BPO providers can implement intelligent claim routing and triage mechanisms. RPA bots can analyze claim data, evaluate predefined rules, and assign claims to the most appropriate resources or departments within the BPO organization. This intelligent allocation ensures that claims are handled by experts with the necessary skill sets and domain knowledge, optimizing resource utilization and accelerating claim resolution.

Exception Handling and Fraud Detection

RPA in BPO plays a crucial role in identifying exceptions and potential fraud cases during claims processing. By employing rule-based algorithms and machine learning capabilities, bots can identify suspicious patterns, flag unusual claim activities, and trigger alerts for further investigation. This proactive approach enables BPO staff to focus on more value-added tasks and enhances fraud detection and prevention, protecting insurers from financial losses and maintaining the integrity of the claims process.

In a Nutshell

The integration of RPA and BPO has proven to be a game-changer in claims processing for P&C insurance. Through this powerful alliance, insurers can embrace a future of:

- Streamlined operations

- Improved accuracy, and Elevated customer experiences

Are you ready to witness the transformative potential of RPA and BPO integration? Contact us today to take your insurance operations to a new height!

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence