Data is the lifeblood of the industry. From underwriting and claims processing to risk evaluation and fraud detection, data plays a pivotal role in every aspect of insurance operations. Every day, new competitors enter the fray, and each of them gets access to a data mine. Nevertheless, only those capable of transforming this data into valuable insights can effectively harness its potential.

However, the sheer volume and complexity of data have made it increasingly challenging for insurance companies to extract actionable insights effectively.

However, outsourcing to a trusted partner could help in using data analytics to get insights into new markets, clients, risks, laws, and so on. In this blog post, we'll explore how outsourcing data analytics can be a game-changer for the insurance industry.

With opportunities come obstacles: Data challenges faced by insurance companies:

As the importance of data analytics in insurance grows, so do the challenges associated with managing and analyzing vast datasets. Here are some common hurdles:

- Data Volume: Handling massive amounts of data from policyholders, claims, and other sources makes it difficult to process manually.

- Data Complexity: Handling unstructured and diverse amounts of data makes it challenging to extract meaningful insights without advanced analytics tools.

- Technology Infrastructure: Maintaining the necessary technology infrastructure for data analytics can be a significant financial burden.

The Role of Data Analytics in Insurance:

Data analytics can transform the insurance industry, enabling companies to make more informed decisions and better serve their customers. By analyzing historical and real-time data, insurance firms can:

- Assess risks more accurately

- Detect fraudulent claims

- Personalize offerings for customers

- Optimize pricing strategies

- Improve claims processing efficiency

Outsourcing as a Solution:

According to reports, the Data Analytics Outsourcing Market is expected to register a CAGR of 34.33%, reaching USD 60.02 billion by 2028.

Outsourcing data analytics has emerged as a strategic solution for insurance companies looking to leverage the power of data without the associated challenges. Here's why outsourcing is gaining traction:

- Access to business intelligence and analytics tools: Use cutting-edge analytics tools and technology like Tableau, Power BI, etc. to analyze your data accurately.

- Systematic data management: Manage and store valuable data across all their platforms with utmost security.

- Tailored solutions: Assure yourself of getting customized software solutions that help your team analyze customer sample data thoroughly.

How does a comprehensive data analytics framework look?

An effective data analytics framework operates through a clearly defined process comprised of sequential stages. These stages encompass:

- Project understanding: Grasp the business objectives and goals and formulate project plans accordingly.

- Data cleansing: Identify all data sources, gather them, and cleanse the data to ensure uniformity in alignment with the devised plan.

- Exploratory data analysis: Conduct exploratory data analysis to gain initial insights once data standardization is achieved.

- Application of analytical techniques: Select the appropriate data analysis technique for extracting patterns and trends after building on the initial insights.

- Interpretation of patterns: Interpret the findings and present them using visualization methods to enhance comprehension.

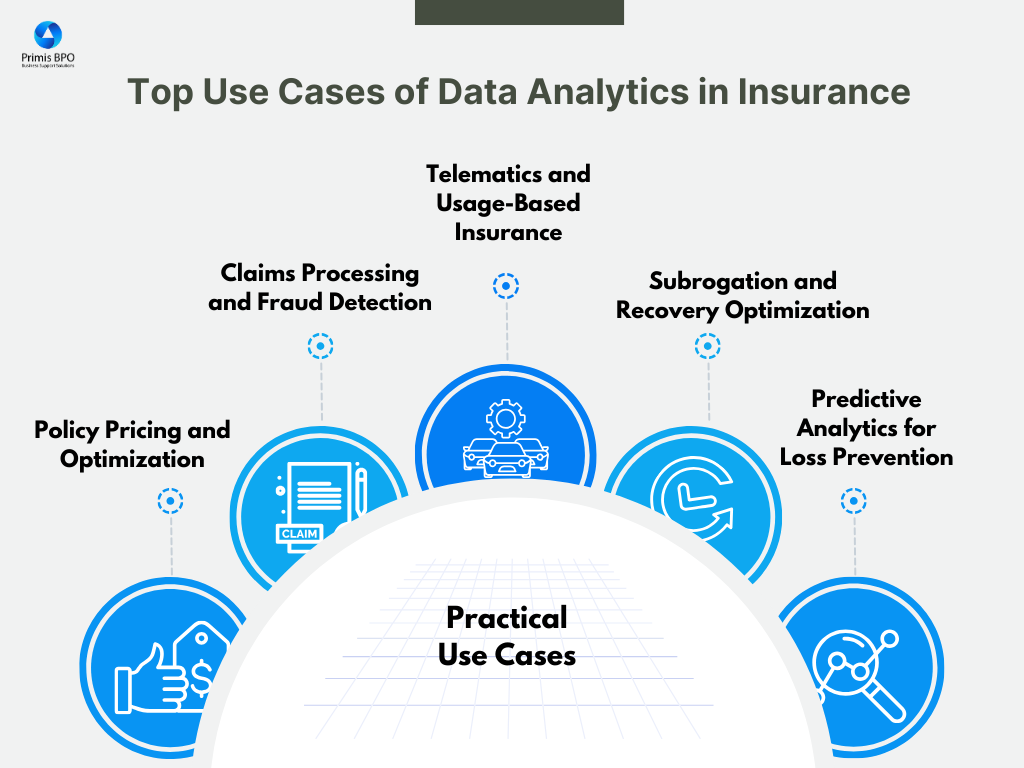

Insurance analytics you can leverage via Outsourcing:

Utilizing a customer-centric approach, a global delivery network, expertise in the insurance domain, and innovative solutions for insurance analytics can distinguish your position in the competitive landscape.

Several pivotal analytics within the realm of insurance industry analytics encompass:

- Claims analytics: Employ comprehensive claims analytics solutions to enhance operational efficiency and mitigate the risk of fraudulent activities while delivering a superior customer experience.

- Subrogation analytics: Optimize subrogation recovery based on patterns, data analysis, business rules, and other relevant factors by harnessing predictive analytics to identify opportunities and employ arbitration for dispute resolution.

- Insurance fraud analytics: Utilize end-to-end insurance fraud analytics solutions to enhance the accuracy and speed of fraud detection. These solutions employ text mining techniques to extract insights from structured and unstructured data sources, including emails, claim notes, police reports, medical records, web- based content, and call center notes.

- Insurance customer analytics: Leverage advanced analytics to elevate client engagement and attract new customers through effective upselling and cross- selling strategies.

In a Nutshell:

In conclusion, data analytics is reshaping the insurance industry, allowing companies to make more informed decisions, reduce risks, and improve customer satisfaction. Outsourcing data analytics has emerged as a strategic move for insurance companies, offering cost-efficiency, expertise, and access to advanced tools.

By carefully considering outsourcing partners like Primis BPO and addressing potential challenges, insurance firms can position themselves for success in an increasingly data-driven world.

If you're interested in harnessing the power of data analytics through outsourcing for your insurance company, please feel free to reach out to us to get tailored services as per your specific needs. The future of insurance lies in data, and outsourcing can help you unlock its full potential.

Recent Blogs

The AI FTE Approach to Property Risk Assessment

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization