Brief Summary: The importance of strategic outsourcing in insurance claims intake is undeniable. This blog highlights how outsourcing can accelerate the process, reducing the turnaround time and improving customer satisfaction.

To begin with, let's consider a scenario:

For instance, imagine someone has just experienced a minor car accident. The stress is mounting, and he/she is eager to get his insurance claim. However, when they call their insurance provider, they are placed on hold for what feels like an eternity, then transferred repeatedly, forced to recount their traumatic experience over and over.

Frustrating, right?

This scenario isn't just a hypothetical nightmare; it's a common reality for many policyholders.

In fact, according to recent research, 33% of customers cite waiting on hold as their top frustration, while another 33% are irked by having to repeat themselves to multiple representatives. These inefficiencies can drive customers away faster than the claims process itself.

This is where outsourcing insurance claims intake can be helpful. That being said, this blog will explore the challenges related to in-house claims intake and how outsourcing can help improve operational efficiency.

When Should You Consider Outsourcing for Your Claims Intake Process?

Deciding when to outsource your claims intake process can be crucial for the efficiency and effectiveness of your insurance operations. Various factors can influence this decision. By evaluating your current processes and identifying areas for improvement, you can determine the optimal time to seek external support. Here are a few challenges that may compel you to opt for outsourcing:

- Your FNOL process is slightly slow and repetitive.

- Your FNOL process isn’t flexible enough.

- Your FNOL process is a little discriminatory.

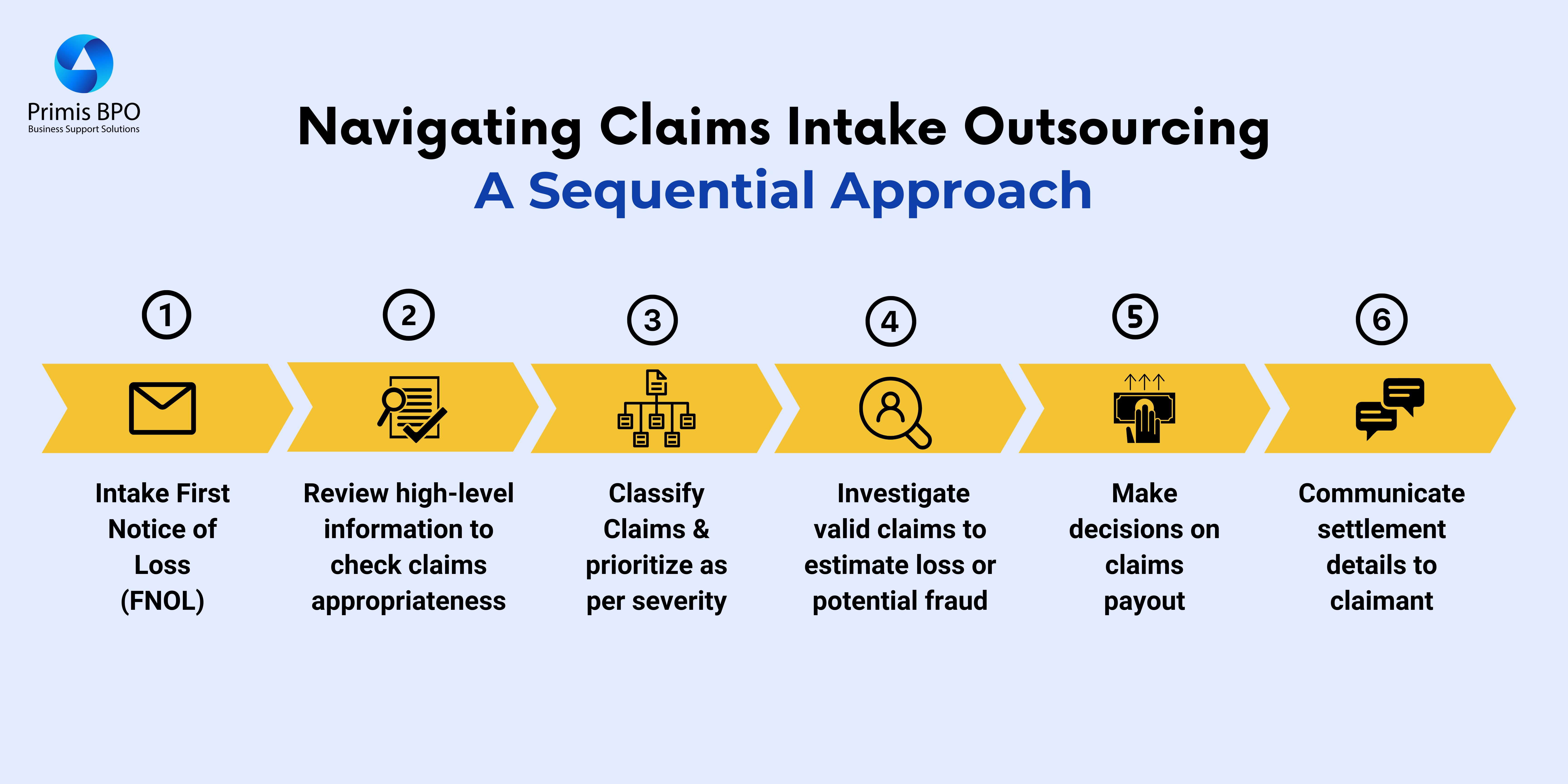

6 Key Ways in Which Outsourcing Elevates Insurance Claims Intake Process

Outsourcing claims intake can address the aforesaid challenges by providing efficient, flexible, and unbiased services, ensuring that FNOL processes are streamlined, accessible 24/7, and handled by empathetic, culturally aware representatives. Here are a few ways in which it elevates the process:

Rapid Claims Triage and Prioritization:

Outsourcing partners can enhance the triage and prioritization of claims by:

- Immediate Classification: Quickly classify incoming claims based on severity and complexity using predefined criteria and advanced algorithms.

- Priority Handling: Expedite high-priority claims, ensuring they are processed and addressed faster, thereby improving customer satisfaction and reducing potential losses.

- Data-Driven Triage: Utilize data analytics to predict claim urgency and route them to the appropriate adjusters or departments for swift action.

Enhanced Accuracy in Data Collection:

Professional FNOL intake providers focus on precision in capturing claim details, which minimizes errors through:

- Standardized Forms: Use standardized, comprehensive forms to ensure all necessary information is captured accurately at the first point of contact.

- Real-Time Data Validation: Implement real-time data validation techniques to check for inconsistencies or missing information during the intake process.

- Detailed Documentation: Ensure thorough documentation of all reported details, including supporting evidence like photos or videos, which can be critical for later stages of claims processing.

Immediate Access to Policy Information:

Outsourcing partners can ensure quick access to policy details to facilitate faster claim initiation:

- Policy Lookup Tools: Integrate tools that allow immediate retrieval of policy information based on minimal inputs like policy numbers or customer details.

- Pre-Approval Checks: Implement pre-approval checks that verify coverage details and deductibles instantly, allowing faster decision-making on claim admissibility.

- Linked Databases: Use linked databases to access historical claims data, providing context and helping in the accurate assessment of new claims.

Proactive Communication Systems:

Outsourcing providers enhance communication with policyholders through proactive engagement using:

- Integrated Call Centers: Use integrated telephony systems that automatically log calls and sync with claims management software, ensuring no detail is lost.

- Omnichannel Support: Offer omnichannel communication options (phone, email, chat, app) for policyholders to report claims, making the process more accessible and convenient.

- Automated Call Routing: Implement automated call routing to connect policyholders with the right specialist immediately, reducing wait times and enhancing service quality.

- Personalized Follow-Ups: Schedule personalized follow-up calls or messages to check in with policyholders post-FNOL, ensuring they feel supported and informed.

Faster Initial Response Times:

Outsourced FNOL services can significantly reduce the time it takes to respond to a new claim through:

- 24/7 Availability: Provide round-the-clock availability, ensuring that claims are reported and acknowledged immediately, regardless of when they occur.

- Dedicated FNOL Teams: Employ dedicated teams trained explicitly for FNOL intake and specialized in auto or property claims, ensuring they handle the initial contact efficiently and empathetically.

- Instant Acknowledgment: Send instant acknowledgment messages or emails to policyholders upon claim submission, confirming receipt and outlining the next steps.

Seamless Integration with Insurer Systems:

Outsourcing partners can integrate seamlessly with an insurer's existing systems to streamline processes through:

- API Integration: The outsourcing provider can integrate their system with the insurer's claims management platform using APIs, enabling real-time data transfer and updates.

- Custom Workflows: Develop customized workflows that align with the insurer's procedures, ensuring a smooth transition from FNOL intake to claim processing.

- Data Synchronization: Ensure continuous data synchronization between the outsourcing provider and the insurer's systems, maintaining up-to-date records.

Decoding the Data: What Do the Stats Reveal?

According to a Forbes report, approximately two-thirds of businesses identify cost savings as a key benefit of outsourcing, and 37% of small businesses have already outsourced at least one function.

Additionally, the report highlighted that the business process outsourcing industry is projected to reach $525 billion by 2030, indicating a growing recognition among companies of the significant value outsourcing can contribute to their operations.

To Wrap Up

The evolving insurance industry demands strategic initiatives to enhance operational efficiency. Outsourcing the insurance claims intake process is a transformative move, allowing insurers to focus on core competencies while experts manage the claims. This approach not only streamlines operations and improves customer experience but also facilitates scalability. Embracing outsourcing for claims intake positions insurers for sustained growth and heightened efficiency in a competitive market.

Planning to outsource your FNOL intake process to a reliable third party? Primis BPO is here to help! Our comprehensive claims intake services, through both digital and traditional channels, expedite the claims process.

Recent Blogs

Optimizing Auto Insurance Underwriting Through Outsourced AI-Driven Risk Intelligence

[Checklist] From Traditional BPO to Digital Powerhouse: 6 Capabilities Your Tech-Enabled Outsourcing Partner Must Have

Outsourcing AI-Enabled Property Risk Analysis

Outsourcing AI-Powered Risk Assessment for Insurance Optimization

Augmented Underwriting: When Human Expertise Meets Digital Intelligence